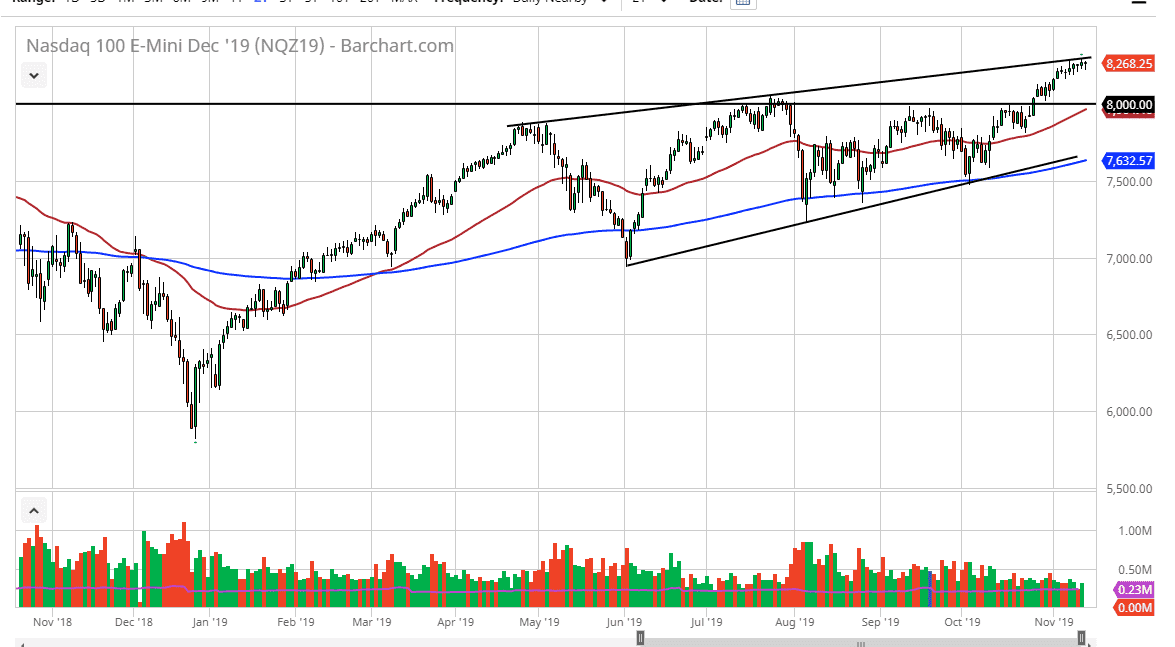

The NASDAQ 100 has rallied during the trading session after initially pulling back on Wednesday but at this point in time it’s obvious that we will continue to find resistance just above. Quite frankly, the stock market in general is a bit extended at this point so we are either going to see some type of sideways grind in order to kill time and digest gains, or we are going to see a pullback in order to find a bit of value. Underneath, I believe that the 8000 level is a major “floor” in the market, and therefore should offer a ton of support. Further back in that idea up is the fact that it is a large, round, psychologically significant figure. Furthermore, the 50 day EMA is getting ready to cross that level so it all, lines up perfectly for a buying opportunity.

The 8000 handle was also the top of the ascending triangle that suggests that we could go as high as 8800, but I think it’s probably down the road that we see something like that, not anytime soon. This market is very sensitive to the US/China trade situation as so many of the technology companies work heavily in both countries. If those things work themselves out, that should be a major boon for the NASDAQ 100 in general.

To the downside, if we were to break down below the 50 day EMA and the 8000 handle, then it’s likely that we could go down to the 7700 level. Overall, I don’t like selling and I think it’s only a matter of time before we find buyers underneath and push this market back towards the highs again. The NASDAQ 100 will continue to be very choppy, and if we did somehow break out to the upside and clear the candlesticks from the last few days, then we will get more of an impulsive move to the upside. In general, I think that buying dips continues to be the best way to play this market as it offers you a little bit of value, something that is sorely missing from the market at the moment. Overall, this is a market that I do think eventually reaches that 8800 level but will probably take several months to get there. As headlines continue to come out back and forth between the US and China, that will continue to throw this market around like a ragdoll.