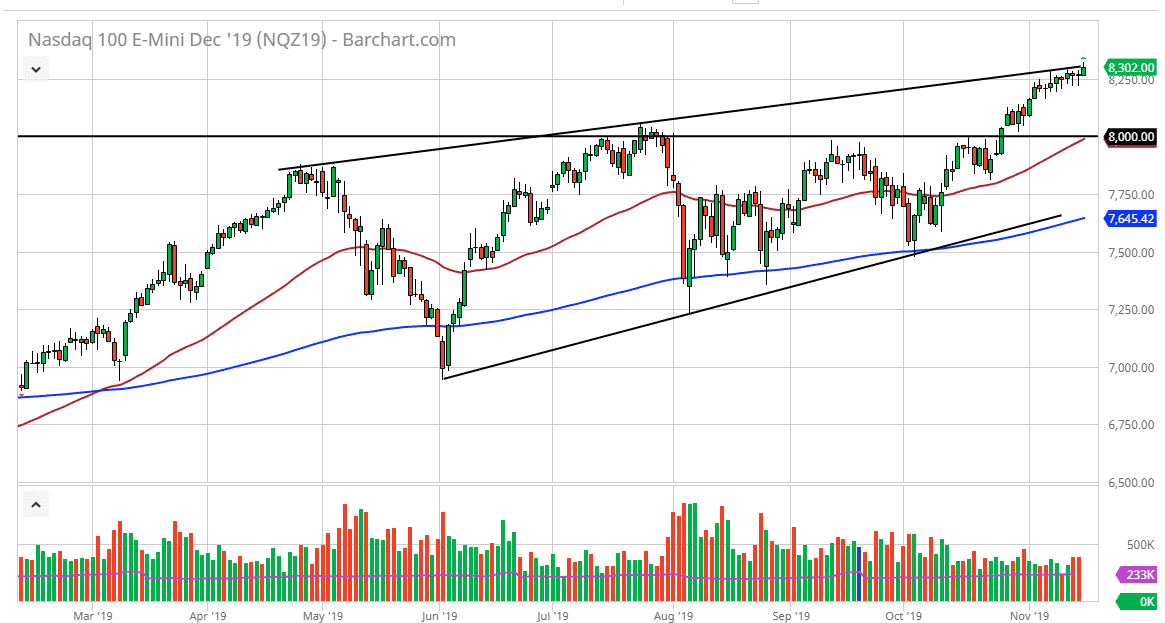

The NASDAQ 100 has rallied a bit during the trading session on Friday again, as we are broken above the 8300 level. That being the case though it appears that we did sell off a little bit at the end of the day, as the market is getting a bit extended. The rally was probably based more upon the words coming out of Larry Kudlow’s mouth suggesting that the United States and China were getting closer to making a trade deal. Unfortunately, we’ve heard this story before so it’s no reason actually make this a bullish market.

That being said though, the market has clearly shown itself to be bullish over the longer term, and we have been grinding higher. We have killed a lot of time appear after an impulsive move higher, but as we are at the top of the overall channel, it looks like we are going to run into a bit of resistance. Pullbacks at this point will probably be met with buyers, but I like to see a significant pullback in order to go along. The 8000 level would be an excellent opportunity to start buying, as it is a large, round, psychologically significant figure, and of course has been resistance in the past as we broke out of the ascending triangle. We have yet to retest that level, and as a result if we pull back, I think it will probably show a significant amount of support. Overall, I think the market would bounce enough to continue going higher longer term. Beyond that, the 50 day EMA underneath should offer support.

The alternate scenario of course is breaking above the top of the candlestick for the trading session on Friday, and that could send this market looking towards 8500 level next. Based upon the ascending triangle from previous trading should send this market looking towards the 8800 level given enough time. At this point, it does look like momentum is running out a bit so I do favor a move to the downside, but again I’m not willing to short this market, I think looking for value is probably the best way to go as the trend has been so strong that it’s almost impossible to imagine a scenario where we should be shorting. All things being equal I like the idea of finding value in this market as we should continue to go much higher.