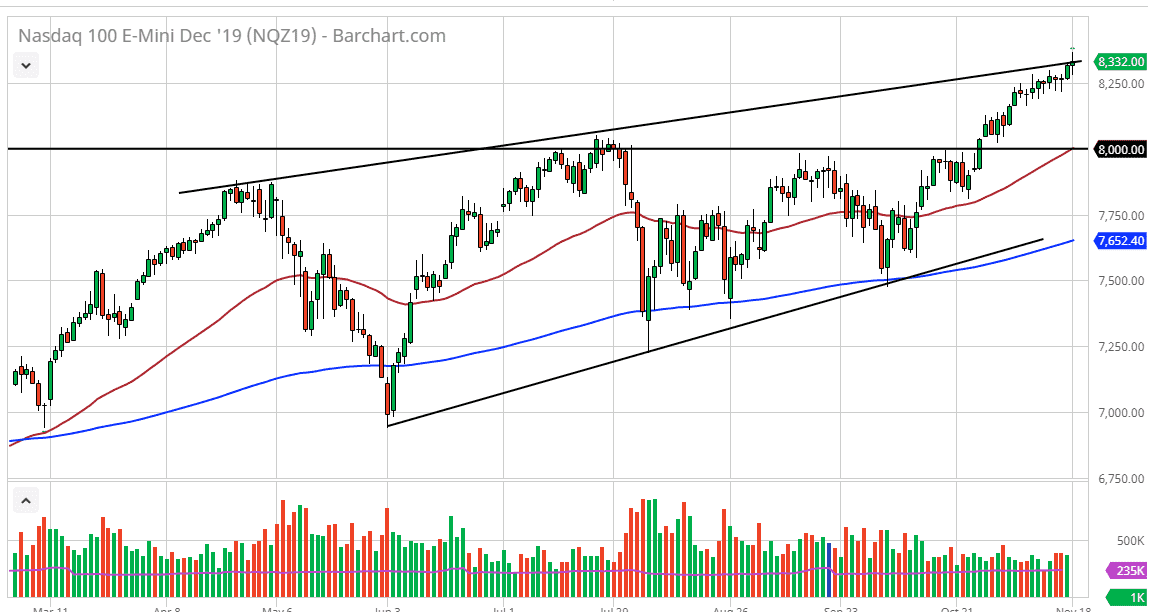

The NASDAQ 100 has gone back and forth during the trading session on Monday to kick off the week, but at this point it looks very difficult to continue going higher as we are at the top of the longer term uptrend channel. The fact that we have formed a neutral candlestick tells me that the market is going to continue to be a bit erratic and perhaps even struggle, but at this point I suspect that the market will probably pull back to find buyers closer to the 8250 level. At this point, the market probably will find buyers in that general vicinity. We are bit overextended though, so it is possible that we break down from here.

If we were to break down below that area, it’s possible that the market participants will go looking for value, as the market has been so bullish and probably needs to take a bit of a rest. The Monday session was a bit of a massive though, as initially the Chinese suggested that the conversation over the weekend with very constructive, but then report came out that it has been less than effective, and that set the market right back down. At this point, the market seems to be a bit overextended, but it might’ve just been an excuse to pullback as we have gotten ahead of ourselves. I think that the 8000 level is the absolute “floor” underneath the market and should continue to be thought of as the base of support.

Beyond that, the 50 day EMA is starting to cross above that level, so we may continue to go even further. Regardless, it’s obvious that you should not be selling this market even if we do pullback from here. The market has continued to show buyers every time we have dips, and even though the latest headlines are confusing, I don’t think that we are anywhere near any type of major blow up.

If we were to break above the highs of the trading session for Monday, it could then send this market higher, perhaps reaching towards the 8500 level. This would be more of an impulsive move, as it would break above the top of the channel. While I don’t prefer of that, I would recognize it as an extraordinarily bullish sign. All things being equal though I prefer to look for value in the stock markets as they have gotten so bullish out of late.