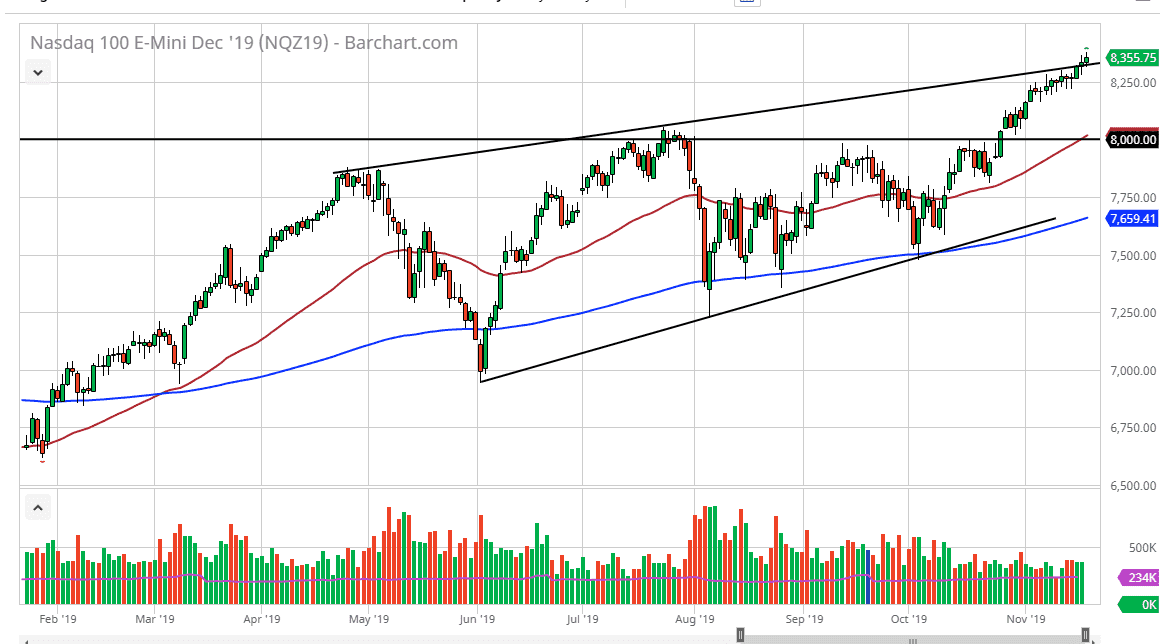

The NASDAQ 100 went back and forth during trading on Tuesday, but ultimately finished higher, showing signs of strength yet again. We are above the top of the overall wedge that the market had been grinding higher, so it looks as if we are going to get a bit impulsive here. Because of this, I believe that the NASDAQ 100 will lead the way for other indices in the United States.

Keep in mind that the NASDAQ 100 is very sensitive to the US/China situation, so therefore it will have a particular interest on the US/China trade tweets and announcements. At this point I think the 8250 level underneath is going Dr. significant support, extending down to at least the 8200 level. Underneath there, 8100 and of course the 8000 level both offer major psychological support as well. The 50 day EMA is just above the 8000 level as well, so that’s another reason why I think the buyers might get involved at that point. Ultimately, I think if we were to break down below the 8000 level, then we could break down a bit to the downside towards the 200 day EMA, but I think it’s very unlikely that we do break down below the 8000 handle, and I believe that we are much more likely to go much higher.

Looking at the market, you can see that the ascending triangle that we broke out of hasn’t been tested yet, so the possibility of reaching down towards the 8000 level is possible but more importantly, the measured move is to reach towards the 8800 level, which means we have quite a way to go to get there. Don’t be wrong, there will be occasional pullback, but that pullback should be thought of as value as nothing will have changed, and quite frankly the market seems to be a bit on autopilot. Global economic numbers are picking up a bit, so it’s likely that we will continue to see a lot of cross-border transactions, and that tends to help technology companies such as the ones found on the NASDAQ 100. With the Federal Reserve stepping on the sidelines, it means that we don’t have to worry about the Federal Reserve tightening up monetary policy which works against stocks. Quite frankly, the Federal Reserve has been taught not to do anything to break down the stock market and therefore one would have to assume that the monetary methadone continues.