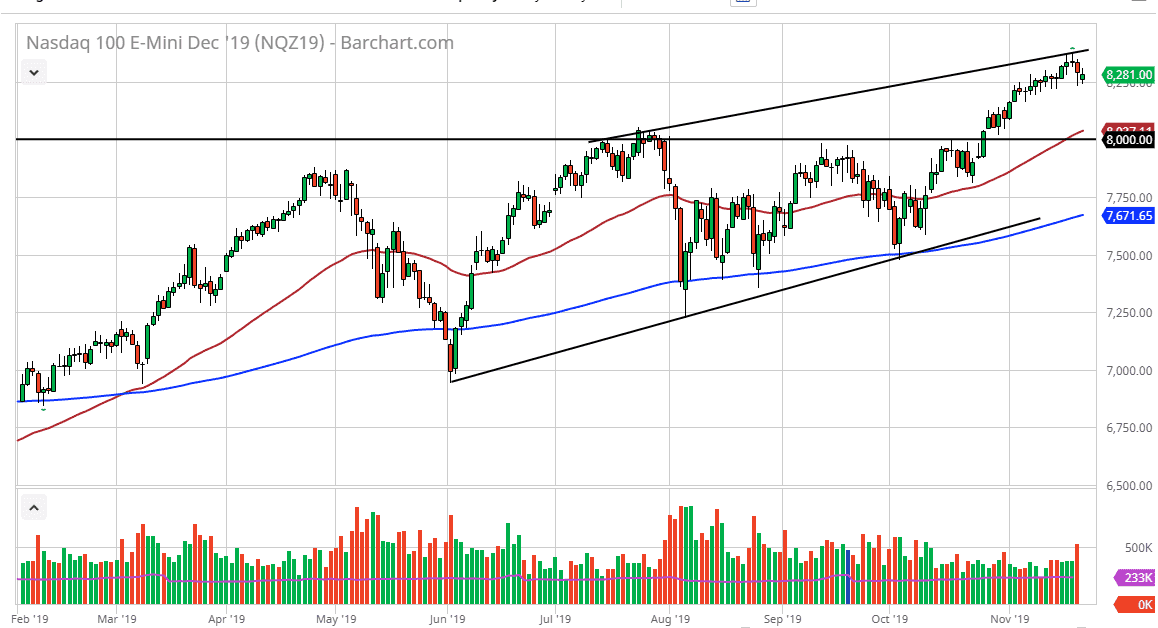

The NASDAQ 100 has gapped lower to kick off the Thursday session only to go back and forth and show signs of confusion yet again. The market is a bit overextended, so it makes quite a bit of sense that we may run into some trouble just above. Beyond that, you can also make an argument that being at the top of the bullish channel also should bring in some selling pressure as well. At this point, it makes quite a bit of sense that the market will continue to be very noisy, but overall, I suspect that we are probably a bit overextended. If we were to break down below the 8200 level, then it could open up a pullback towards the 50 day EMA which is just above the 8000 handle.

Beyond that, the 8000 level was the top of an ascending triangle that measures a move towards the 8800 level. We have not retested that level for support recently, so it would make some sense to pullback to that area. However, the 8200 level is an area that has seen a lot of support previously, so first the sellers would have to break through there. It’s not so much that I think you should be a seller of the NASDAQ 100, rather that you should be aware that you can get an opportunity to buy it at cheaper levels.

To the upside, if we were to break above the shooting star from the Tuesday session, the market would probably go much higher, and more of an impulsive “blow off top” type of situation. That could have the market accelerating quite rapidly, but at this point I think it’s probably more likely to drift lower. I don’t have any interest in trying to short this market, but I don’t necessarily want to buy it at these higher levels. I suspect that at about the time retail traders and news outlets are talking about whether or not the trend is over, that’s probably going to coincide quite nicely with a buying opportunity. This is something that we have seen time and time again, so there’s no real doubt that it could happen this time as well. That being said, the Federal Reserve is on the side of the stock market these days so they will obviously stay out of the mix in order to keep these indices going higher.