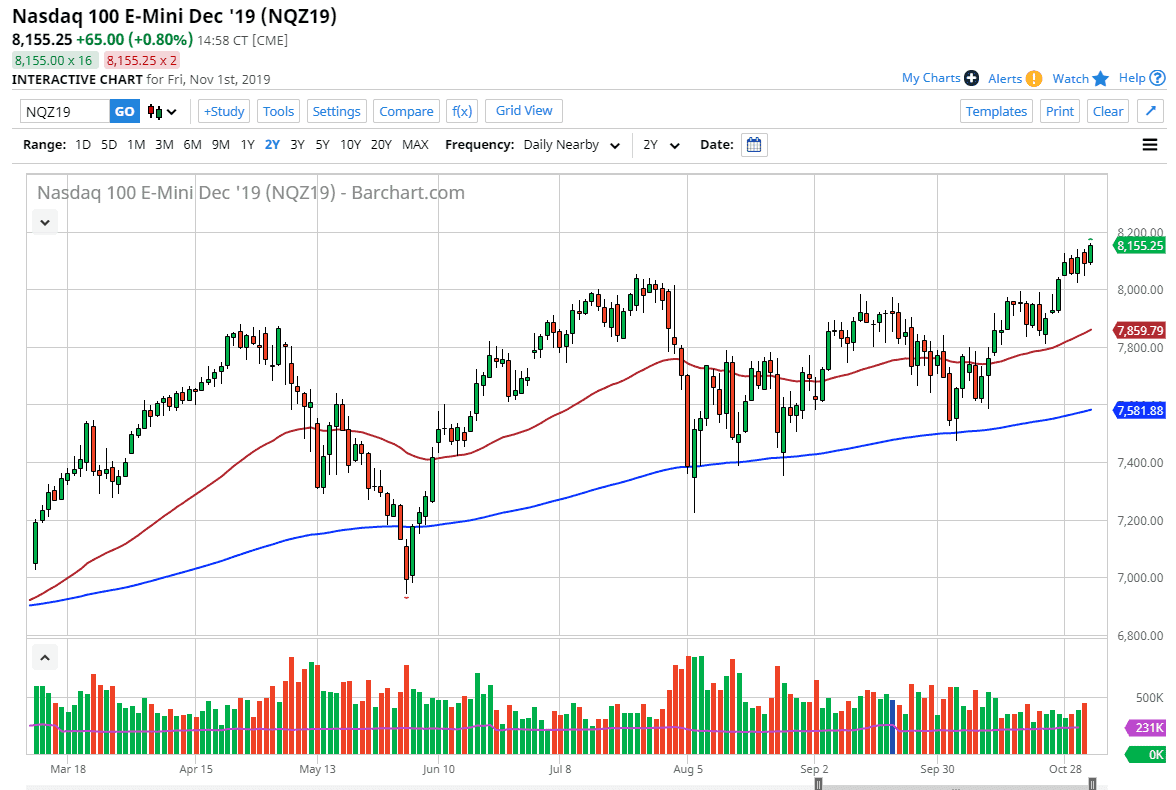

The NASDAQ 100 rally during the trading session on Friday after the jobs never came out better than anticipated. That of course makes quite a bit of sense as it started a “risk on” type of situation. The market has cleared the consolidation from earlier in the week, so I think at this point it’s very likely that we will continue to see buying on dips going forward. The 8000 level underneath should continue to offer plenty of support and is essentially the “floor at this point” as far as the market is concerned.

The 50 day EMA is starting to curl higher and racing towards the 8000 level as well so I think that will only solidify that support. The three candlesticks from earlier in the week that found support at the same price just above the 8100 level also offer a clue as to where the buyers will return if we do get a short-term pullback.

That being said, I suspect that the NASDAQ 100 is somewhat vulnerable to the noise coming out of the US/China trade situation, which although more amicable as of late it appears that intellectual property is still going to be a sticking point, as Chinese gains in technology have quite often been made by outright theft or at the very least “technology transfer.” If something bad happens in that scenario, it’s very likely to break this market down quicker than many of the other ones as so many of the technology companies on the NASDAQ 100 are highly sensitive to trade and going back and forth between the United States and China. With that being the case, on a headline that ends up being very negative between Washington and Beijing, this is the first place that you should be looking for a selling opportunity. At this point though, it does look like the market is ready to continue going higher, and therefore you should only think of all of that as a potential problem along the way.

Buyers continue to pick up this market every time it dips, so if you didn’t get in early enough, you could always wait on a pullback closer to the 8000 level, which should catch a lot of attention by traders around the world and of course cause a lot of headlines to get people involved in the market. I have no interest in shorting this market as things stand currently.