The E-mini NASDAQ 100 contract traded in thin volume during the Thanksgiving Day trading and rose after initially gapped lower. The gap lower was due to Donald Trump signing the “Hong Kong bill” backing the protesters in that city, in spite of Chinese demands that they didn’t. Quite frankly, this bill doesn’t have the realty then it, nor to the Chinese have a way to retaliate with any force. With that being the case, this bluster will probably pass, and we should continue to go higher. However, the Chinese were to suddenly do something drastic, that could throw things into disarray. At this point though, it looks as if the lack of reaction is something that the markets are certainly paying attention to.

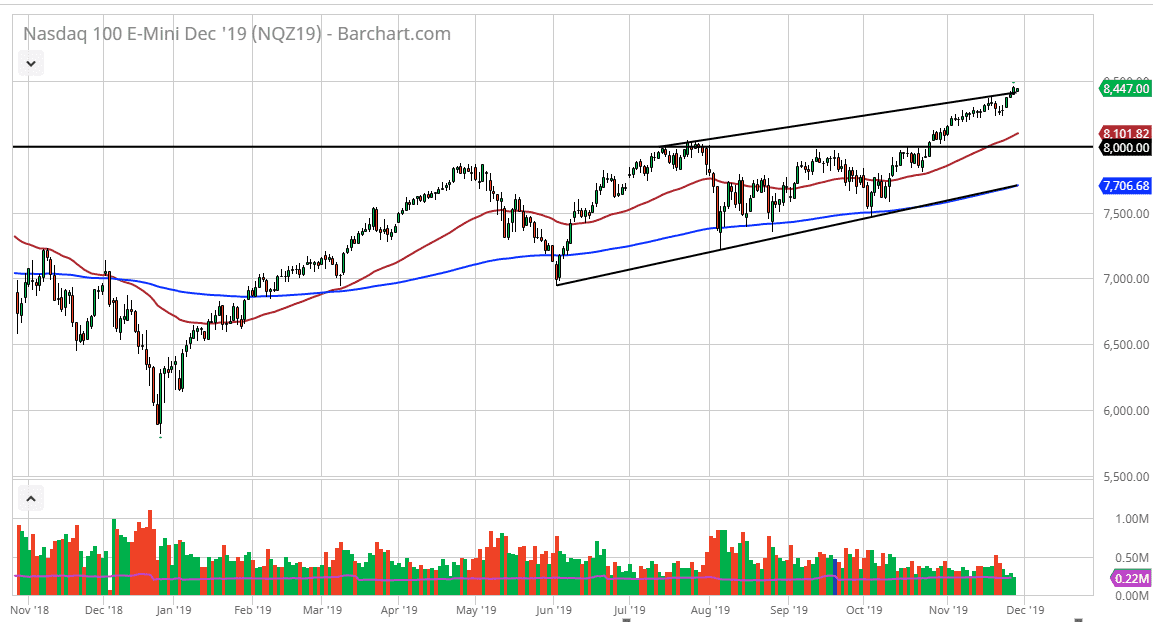

All things being equal, it looks as if we will continue the overall uptrend, reaching towards the 8500 level, and then possibly as high as the 8800 level based upon the ascending triangle that we had broken out of previously. At this point, the market is likely to continue to find buyers every time we dip, therefore it’s likely that the uptrend continues to take off. Looking at this chart, the market is likely to continue to see value hunters coming into the market, for the “Santa Claus rally.” At this point I think it’s only a matter of time before rallies are bought into and I have no interest in shorting. The 50 day EMA is currently trading at the 8100 level, and it’s likely that we will find plenty of buyers there as well. There is no interest on my part in shorting the market, although we are getting a little bit overextended. Though short-term pullbacks though seem to continue to attract a lot of demand, so there’s no need in fighting it.

When we broke above the previous ascending triangle, it was a powerful signal that we were going to go higher. That being said though, the market can’t go straight up in the air, so it’s only a matter of time before we get that bullish action. I have no doubt that it’s only a matter of time before we fulfill the 8800 target, although whether or not we can do between now and the end of the year is of course a significant question. It is not until we break down below the 200 day EMA that I’m interested in shorting the NASDAQ 100.