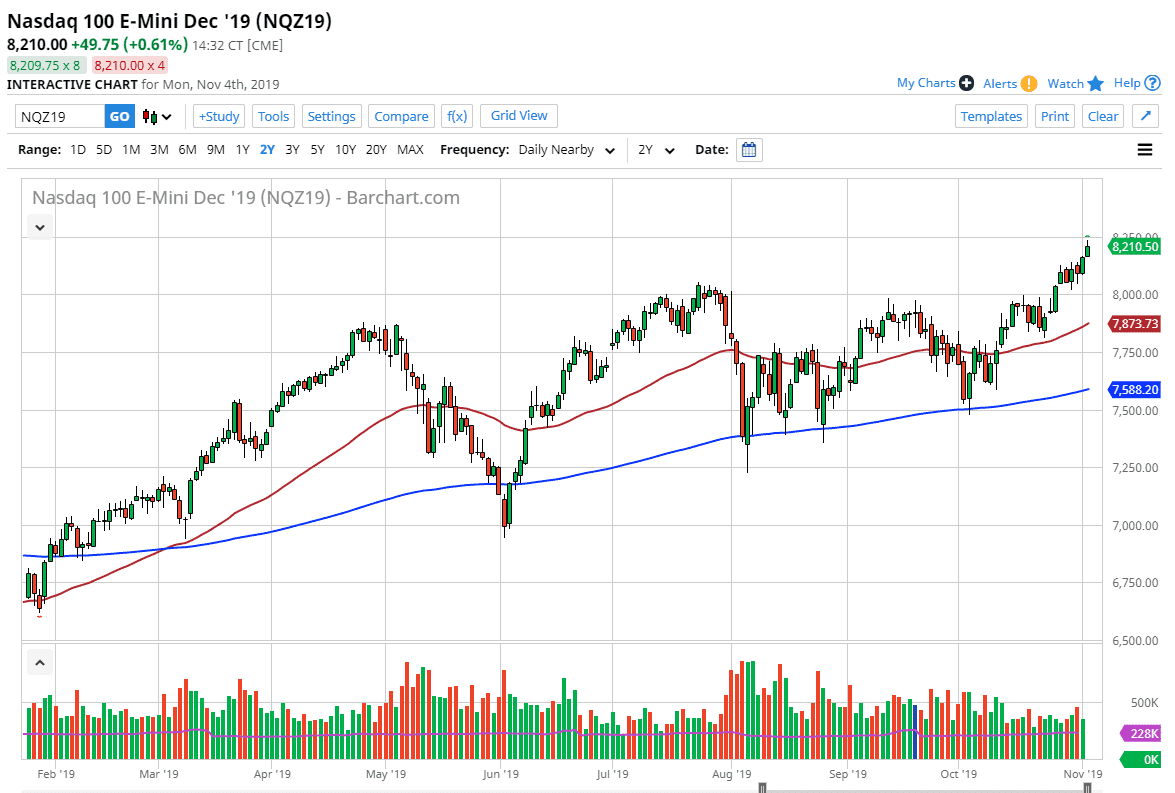

The NASDAQ 100 is currently rallying again, reaching towards the crucial $8250 level. However, the market is most certainly overextended, so I think a short-term pullback is very likely. Yes, there are murmurs of the US/China situation getting better, but we have heard this more than once. Ultimately, a pullback is probably necessary in order to offer value which is something that traders will be very much aware of, so by paying attention to the 8000 level underneath, I think you could see an area where it’s possible to pick up a little bit of value in a trade that has been extraordinarily bullish.

The 50 day EMA is starting to curl to the upside and reach towards the 7900 level, and I think that eventually it will break through there and go to the 8000 handle. Once a breakthrough the 8000 handle that should leave that area in the past, and then we can grind much higher. In the meantime, though it looks as if it is essentially the “floor” in the short term trading.

One thing that we have learned though is that if the market breaks down below the 50 day EMA it almost certainly will go down to the 200 day EMA where it will reset and look for buyers. I believe that this market will continue to lead the S&P 500 higher but should be higher longer-term regardless. Based upon the ascending triangle that was recently broken through we could be looking at a move all the way to the 8800 level. The NASDAQ 100 does tend to be quite a bit more volatile and quicker to move then the S&P 500 so don’t be surprised at all if that’s exactly what happens while the S&P 500 simply chops back and forth in an upward manner.

I don’t have any interest in shorting this market, because every time you have tried to short this market you have more than likely been ran over. As long as central banks around the world are willing to jump in and liquefy the markets, they will only go up over the longer term. That has been the play for 12 years and I don’t see that changing tomorrow. That doesn’t mean that you can buy at any given moment but looking for those support levels makes quite a bit of sense and more often than not they work out.