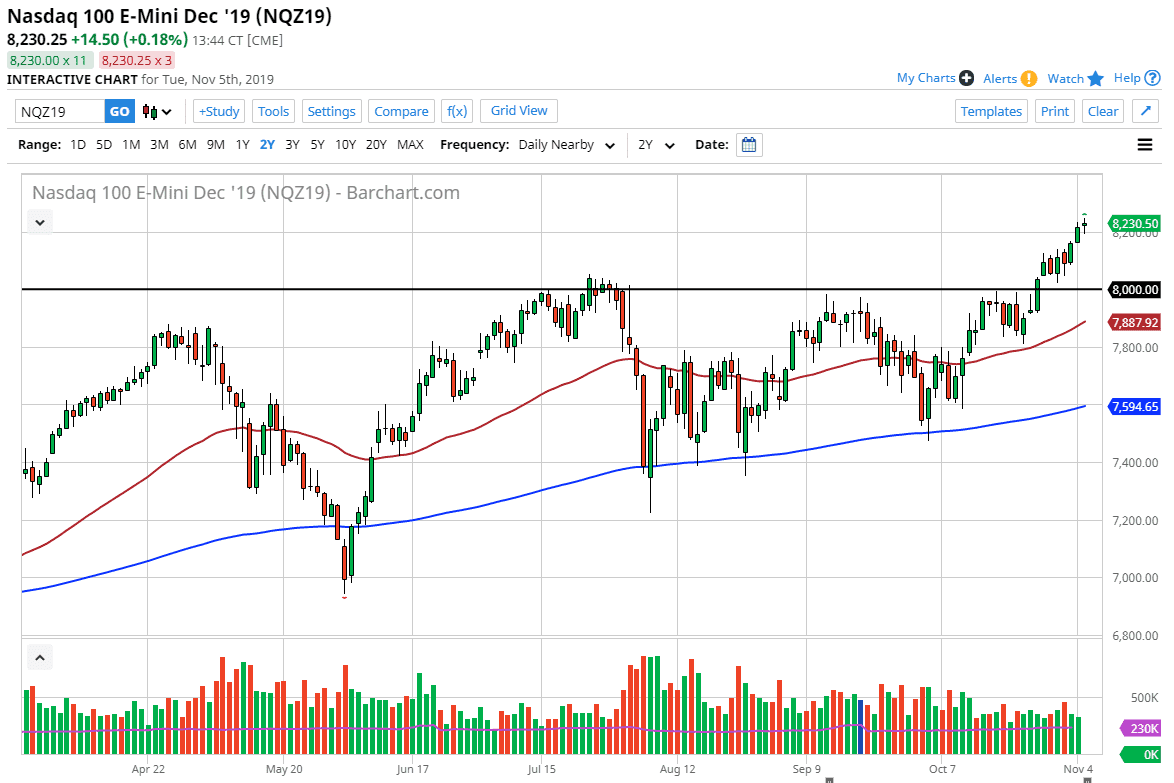

The NASDAQ 100 has gone back and forth during the trading session on Tuesday, showing signs of exhaustion and although the market had looked rather strong initially, the US dollar strength of course has come into play and kept this market from going much higher. The question now is whether or not we get a pullback that breaks down through the 8200 level, or whether or not that offers enough support. I suspect that the market will eventually go higher, but I think at this point it’s likely that the buyers will return sooner rather than later. We are just a bit overextended, but that should offer value.

The 8000 level underneath should be massive support, as it is a large, round, psychologically significant figure and of course the previous resistance it should keep its importance due to market memory. It was the top of the ascending triangle, so that of course means that we are likely to see more buying pressure and a potential move all the way to the 8600 level. Beyond that, we could even stretch all the way to the 8800 level if you include the lowest wick. That being said though, this is a market that looks very likely to go higher anyway, so I like the idea of buying dips that offer value.

If we were to break down below the 8000 level, that more than likely would have the market reaching towards the 50 day EMA which is starting to curl higher and showing signs of strength. At this point, the market likely will find more buyers as well. At this point, I don’t have any interest in trying to short this market, because it is so bullish overall. With that, the market is very likely to find buyers given enough time. I don’t think that we can continue this type of momentum for a lot longer though, as we are certainly overextended and a bit on the parabolic side. However, that doesn’t mean that we can’t find value on dips, and quite frankly I think that’s what a lot of traders will be waiting for. Keep in mind that this pair will be sensitive to the US/China trade situation, at this point that is a fluid situation, so keep in mind that negative headlines could send this market lower. If they do, it’s very likely that we will eventually find buyers based upon value hunting unless of course it’s something completely catastrophic.