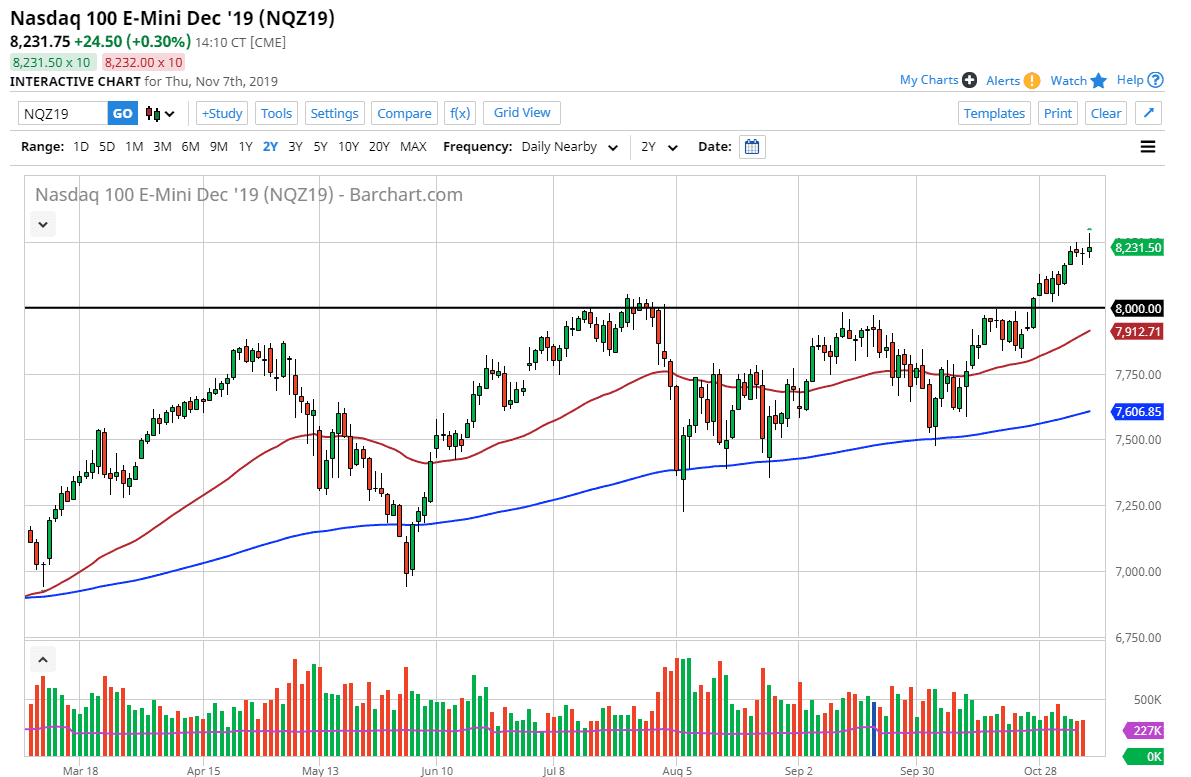

The NASDAQ 100 has initially tried to rally during the trading session on Thursday but has found enough resistance above the 8250 level to turn around and form a massive shooting star. This was due to the headlines coming out that the Americans and the Chinese were willing to roll back some of the tariffs going forward, which of course is a very bullish sign for the trade war situation. However, it was noted later in the day that there is still some internal arguing at the White House about whether or not to do this, so that of course could be a bad sign, and stocks of course sold off as a result.

The NASDAQ 100 is particularly sensitive to the US/China trade situation as most of the large companies in the NASDAQ 100 do a lot of business between the United States and China. With that being the case it’s very likely that the market will continue to be very reactive to these headlines when it comes to the trade wars. The fact that we ended up forming a bit of a shooting star is not a good sign, but we had a hammer during the previous session so this could just simply be the market showing that it is ready to grind sideways in order to try and find whether or not it’s ready to go higher. I think a pullback does make quite a bit of sense though, especially as we go into the weekend. If that’s going to be the case, I suspect that the “floor” is the 8000 handle, assuming that we even get that low.

I look at a pullback as a potential buying opportunity, because it could show quite a bit of value for those who are more long-term mind it did. As far as breaking down below the 8000 level is concerned, that would of course be a very negative sign but right now it doesn’t look very likely to happen. We have been a bit overdone to the upside at this point, so pullback makes quite a bit of logical sense as well. The alternate scenario is that we simply break through the top of the shooting star which would be extraordinarily bullish but would be a bit concerning considering just how overdone we have been recently. Quite frankly, a pullback at this point could be exactly what the market needs for longer-term sustainability.