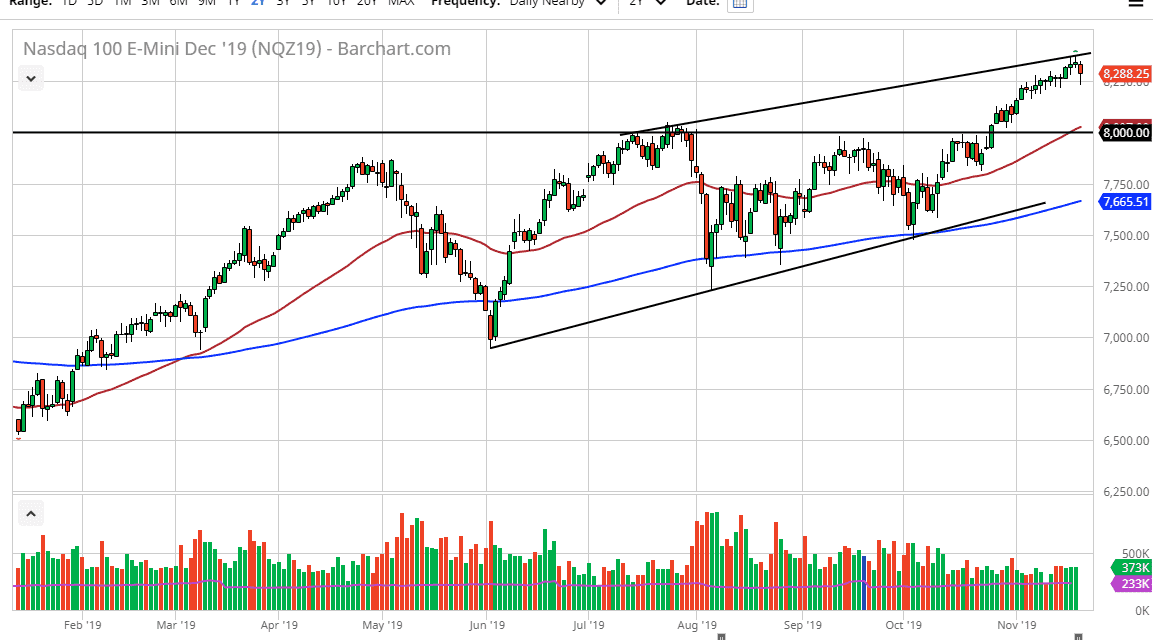

The NASDAQ 100 sold off during the trading session on Wednesday, reaching down towards the 8200 level before bouncing significantly. This is on the heels of President Donald Trump suggesting that more tariffs are likely at this point, as the Chinese haven’t done enough to make him happy. If that’s going to be the case, then it’s likely that a lot of technology stocks will continue to go lower, as they are extremely overvalued at this point. At this juncture, the risk to reward to scenario is in that great, at least not unless we get some type of good news coming out of the US/China trade situation, and in all reality it’s likely that the “Phase 1” being signed between now and the end of the year is probably already priced into a lot of these tech companies.

If we do break down below the lows of the last couple of weeks, it’s likely that the market will then go looking towards the 8100 level, and then eventually the 8000 level as massive support, especially considering that the 50 day EMA is just cross that level. By doing so, it looks as if the market is ready to go higher but may need to pullback in the short term in order to offer value. Overall, the stock markets are overvalued by a lot of metrics, so at this point it makes sense that the market will continue to see buyers on dips, but at this point it’s probably not quite time to do that.

However, if the market is to break above the top of the shooting star from the Tuesday session, then the market will enter and impulsive leg higher, something that I don’t like to be honest, as we have already been a bit impulsive previously. By breaking above the top of the ascending triangle that had been forming, it measures for a move towards the 8800 level, but that doesn’t necessarily mean that we need to get there right now. If we were to break down below the 7900 level, then we really start to test the overall uptrend. Markets have gotten ahead of themselves for some time now, so don’t be surprised if there is a massive shakeout but look at that as a potential buying opportunity at some of the more interesting and obvious lower levels as mentioned previously.