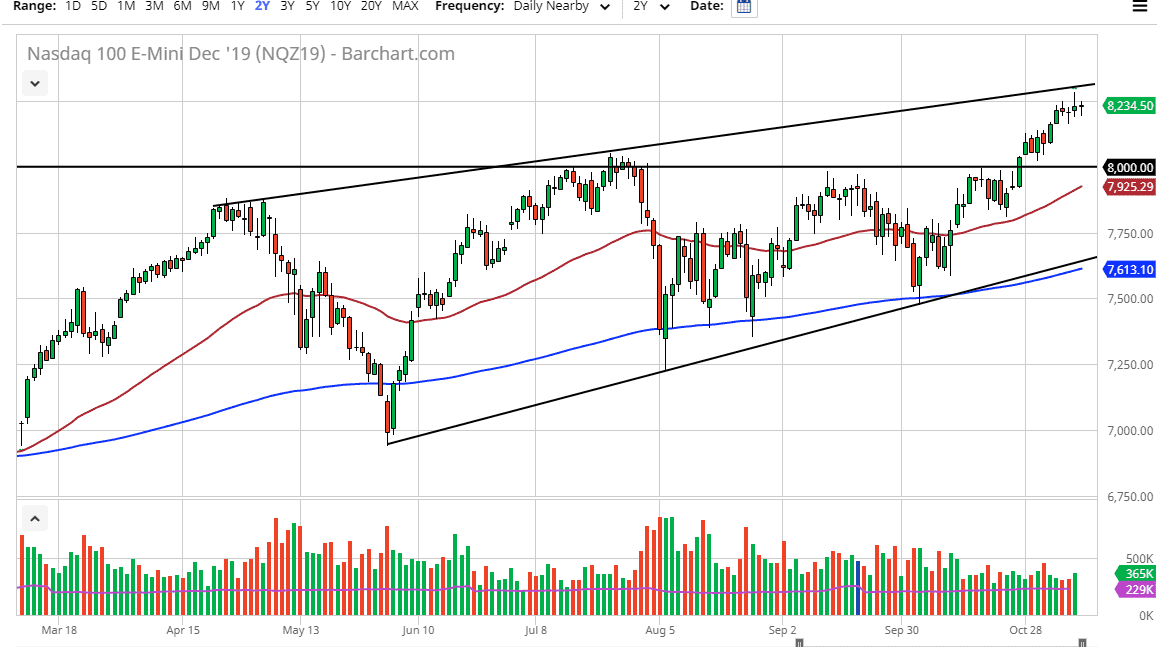

The NASDAQ 100 has gone back and forth during the trading session on Friday as we continue to see a lot of noise in this area. We are at the top of the bullish channel and had seen a lot of resistance near the top of the range during the trading session on Thursday, forming a shooting star. While the pundits of the news media will herald the idea of a fresh, new high close in the NASDAQ 100, the reality is just a simple gain for the day, and a lot of the initial gains during the Thursday session were given away. In other words, although it technically is a fresh new high, the reality is that there is obviously a lot of selling pressure just above.

Further complicating things is the fact that there are conflicting reports as to whether or not the Americans are going to roll back some tariffs against the Chinese. That obviously would be very bullish for the NASDAQ 100 and other risk appetite assets around the world. The NASDAQ 100 is a bit more sensitive to the US/China situation mainly because the major companies in this index tend to do a lot of business in both countries. With this, I suspect that this market will continue to be very noisy but as we are stretch to the upside it would make quite a bit of sense that the sellers would come in and push a bit lower, coinciding with a lot of profit-taking.

To the downside, the 8000 level will more than likely offer a significant amount of support, as it was previously the resistance from the ascending triangle. At this point, the market should offer support their based upon market memory of nothing else. Beyond that, the 50 day EMA is starting to reach towards the 8000 level, as the market will continue to be very choppy and erratic bit more importantly it will be very bullish longer term. The noise from the US/China trade situation continues to cause a lot of issues, but ultimately it looks as if we are going to maintain the uptrend but at the same time it’s very likely that we need to pull back in order to find value. At this point, the market looks likely to see a lot of volatility but then again, a lot of buying opportunities underneath as there is so much in the way of buying underneath.