Natural gas markets have gapped higher to kick off the trading session on Thursday as we start to see more colder temperatures hit the northeastern part of the United States. With that being the case it’s likely that the natural gas markets will continue to go higher, as demand starts to pick up yet again. However, one of the biggest drivers of price has been the oversupply condition in the United States, which still causes some issues. That being said, we are more than likely going to see a dwindling of supply as winter has come early for several parts of the United States.

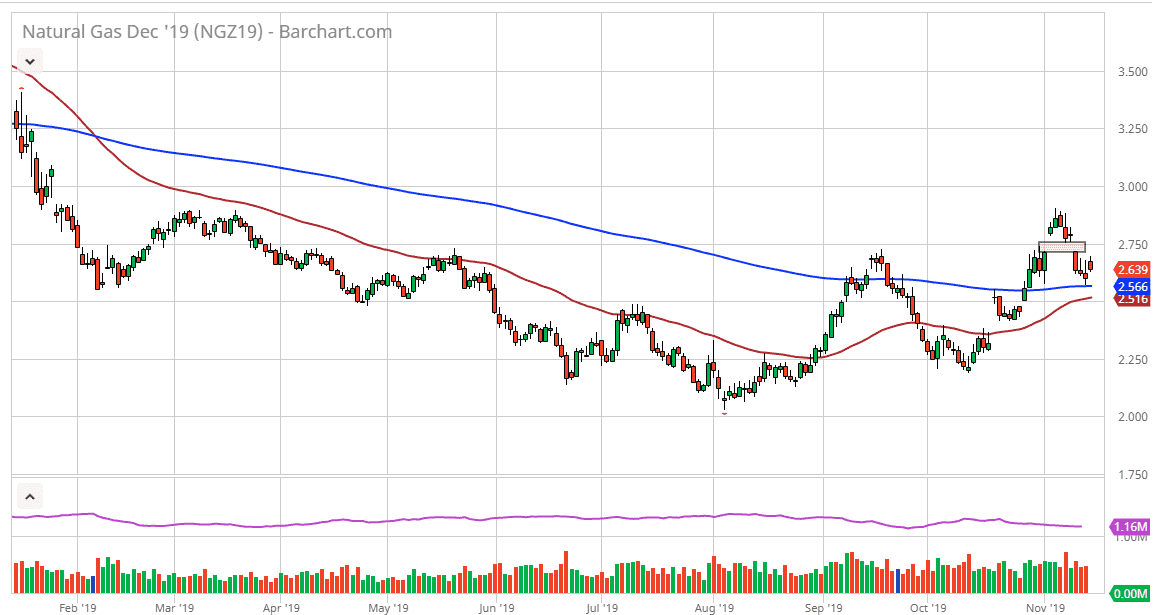

Because of this, I like the idea of buying natural gas, but I also recognize that the $2.75 level is going to cause some issues as there is a gap there. These gaps typically are difficult to break but I certainly think that one thing that you can look into is the fact that the cyclical nature of natural gas does favor higher pricing at this point in the year and until the middle of January. Beyond that, we have made “higher lows” as of late, and therefore it looks as if the trend is changing. For what it’s worth, we also have “higher highs” recently as well so the turnaround certainly seems to have begun, but that doesn’t mean we go straight up in the air.

Short-term pullback should continue to be buying opportunities in general, and I think that will end up being the case going forward. The $2.75 level being broken to the upside would be a very bullish sign as it would clear the gap, but then we would probably go to the $3.00 level as well. If we were to break above the $3.00 level that’s very likely that the market will then go looking towards $3.25 after that. I do think that we probably reach that level as well but that doesn’t mean that it will be easy to get there. The oversupply issue is a major problem for this market, but this time a year does tend to favor buying in general and I don’t plan on trying to fight that overall trend. However, once we get to the middle of January, I will start shorting natural gas hand over fist, as futures traders begin to focus on spring contracts and warmer months.