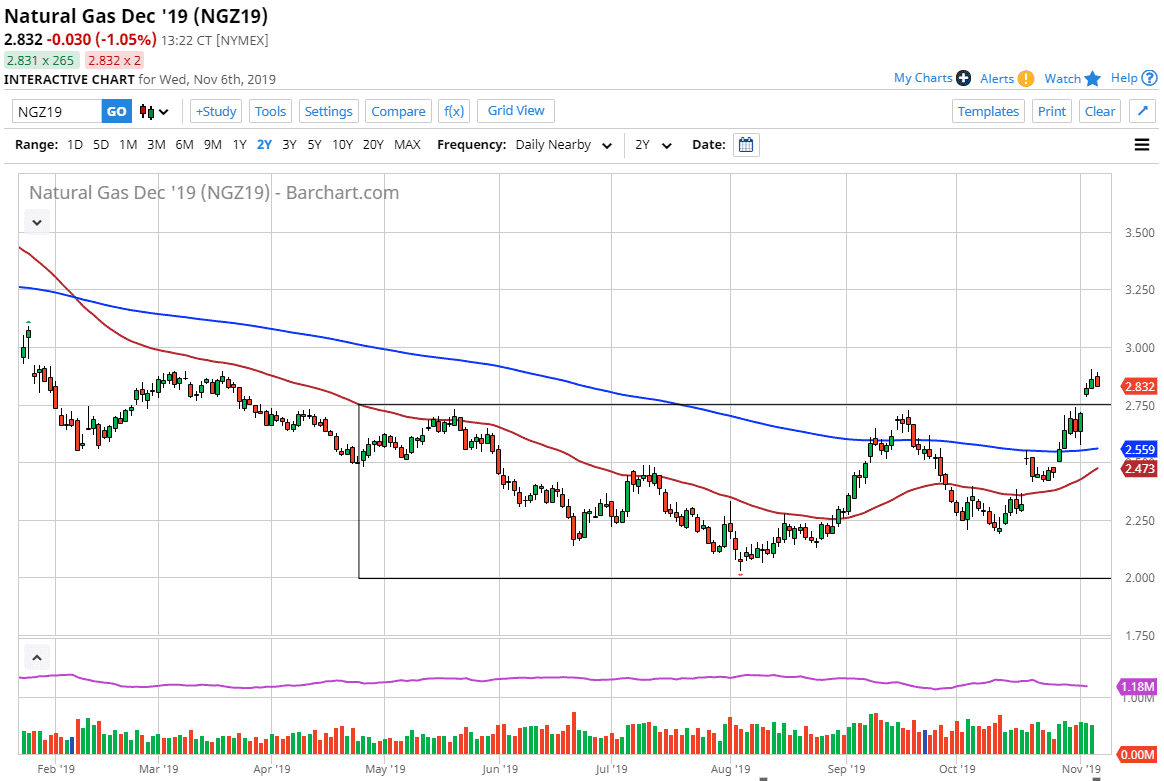

Natural gas markets initially started out the day rather bullish on Wednesday but have pulled back a bit as we are getting a bit extended. Beyond that, the Thursday session is the Natural Gas Storage announcement, and that means of course that the market will be volatile. This could be the excuse that it needs to pullback towards that gap and fill it. Filling that gap could be the perfect excuse to buy natural gas “on the cheap.” That means that the market could drift as low as roughly $2.73 before finding enough inertia to turn around and rally again.

With all of that being said the 200 day EMA currently sits just below the most recent surge higher, and therefore it should also create quite a bit of bullish pressure. Beyond all of that though, the most important thing to pay attention to is the fact that the temperatures in the United States is getting colder. Those colder temperatures offer the idea of more demand coming into the picture, and therefore it should send this market much higher over the longer term. This cyclical trade is one of my favorite, and therefore I have no concerns about taking it. Pullbacks will offer value the people will be taken advantage of, as we drive towards the $3.00 level, and then possibly much higher than that.

This trade tends to run until we get to the middle of January or so, as at that point futures traders are focusing on spring contracts. Obviously, the demand for heating at that point of the year is much smaller than in winter. This will drive the price lower, as there is an abundance of natural gas in general. The trade tends to accelerate to the downside again. This is a market that is oversupplied no matter how you cut it, so even if we do get a nice spike, it’s always temporary. Nonetheless, this is one of the easier traits to take every year as we do shoot straight up in the air. I have no interest in trying to short natural gas anytime soon, but once we get to that point in early to mid-January where trader start to focus on warmer temperature readings in the United States, I will not only short this market but I will stay aggressively short for several months.