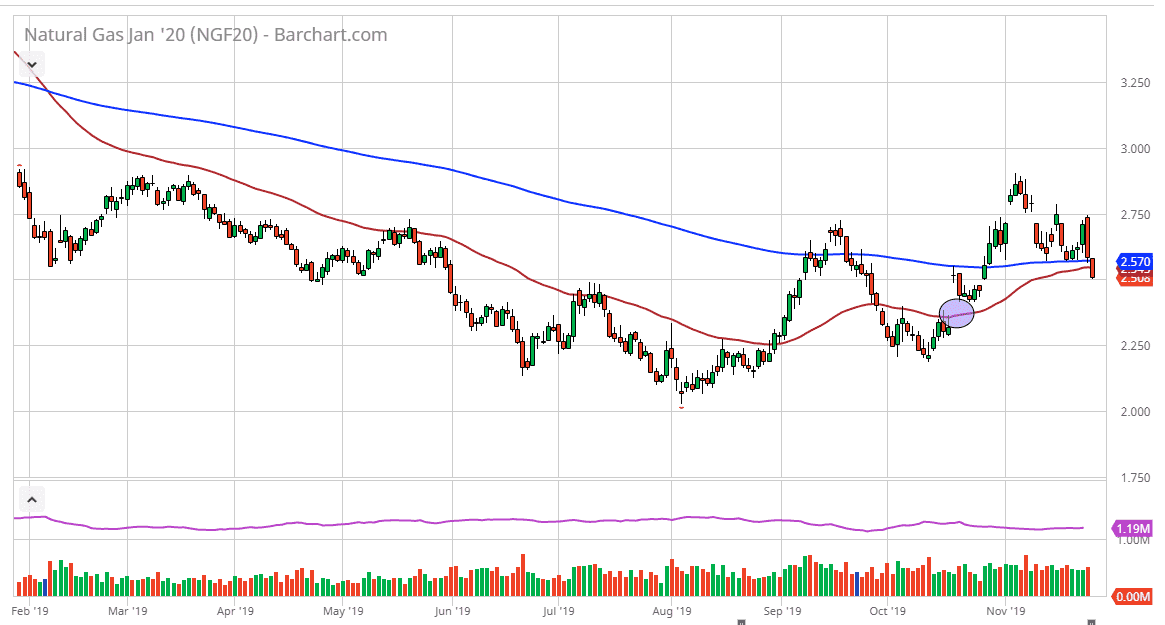

Natural gas markets have broken down a bit during the trading session on Tuesday, slicing through significant support and finally showing a little bit of conviction as we had been going back and forth for some time. This is very interesting, as the market had been consolidating over the less couple of weeks, and it is even more interesting considering that it is the wrong time of year for natural gas to be selling off. That being said, there is a lot of demand this time a year typically, so in general I like buying natural gas rather than selling it. However, US drillers have gone off the rails during the previous year, and supply is still something very difficult to overcome. This is part of the main problems that the market has had developing its so-called “winter pop” that it typically has.

Because we have broken down and sliced through both the 200 day EMA and the 50 day EMA, I think we are then going to be looking towards the gap underneath that is marked on the chart. The gap has yet to be filled, meaning that the market is probably going to be reaching towards the $2.40 level, and just a little bit underneath there as well. In that area, we will fill the gap and attract attention due to the fact that there could be a bit of a trend line forming there, and even at that level, we still have a “higher low” than the previous one. It looks as if we are trying to form a bit of a bullish channel to the upside, so at this point I think this pullback should be thought of as potentially offering value.

As far as selling is concerned, I simply won’t do so this time year, because eventually we do get the explosive move to the upside. If the market does eventually turn around a break above the $2.75 level, I think that will be the beginning of something rather large, and then I would be a seller sometime in January itself. We are currently trading the January contract, so that should be bullish, but eventually during the month of January we will start focusing on springtime contracts, which should be rather negative, as demand will drop precipitously in the United States for heating homes. That being said, we have seen so much over drilling during the earlier part of the year we are still struggling to chew through all of the supply.