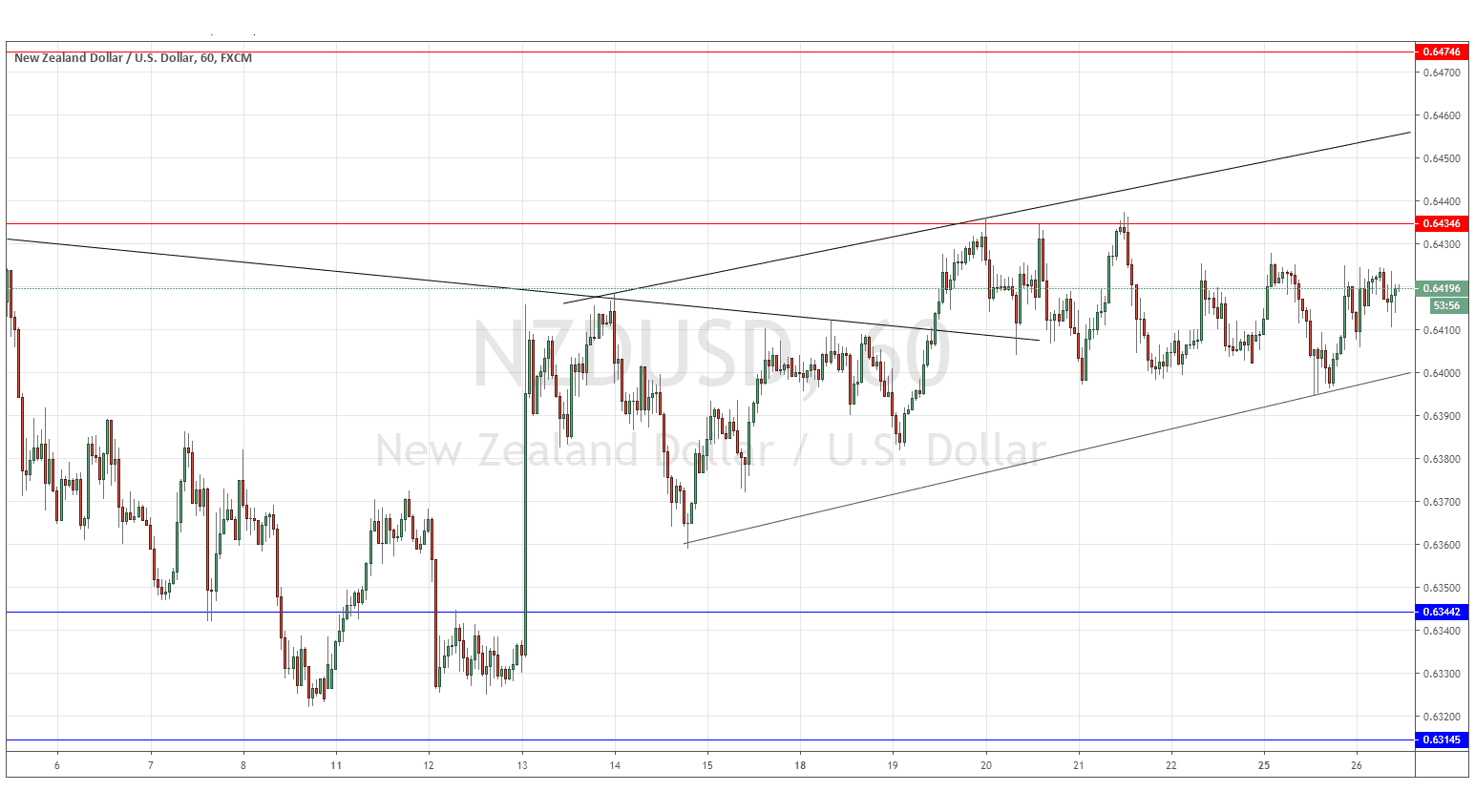

NZDUSD: Bullish flag pattern holding

Yesterday’s signals were not triggered, as none of the key levels were reached.

Today’s NZD/USD Signals

Risk 0.50%.

Trades must be taken between 8am New York time Tuesday and 5pm Tokyo time Wednesday.

Short Trade Ideas

⦁ Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.6435 or 0.6475.

⦁ Put the stop loss 1 pip above the local swing high.

⦁ Adjust the stop loss to break even once the trade is 20 pips in profit.

⦁ Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

⦁ Go long following bullish price action on the H1 time frame immediately upon the next touch of 0.6344.

⦁ Put the stop loss 1 pip above the local swing high.

⦁ Adjust the stop loss to break even once the trade is 20 pips in profit.

⦁ Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

NZD/USD Analysis

I wrote yesterday that I would be prepared to take a short trade entry from a bearish reversal at 0.6435, or if there was a strong bearish breakdown below the lower trend line. This was not a great call as there was a false break below the trend line which would have led to a losing short trade if taken. However, the lower trend line can be readjusted now, as shown below, to produce a more symmetrical bullish channel which should be more reliable due to the symmetry.

Despite the bullish channel structure, the price is finding it impossible to rise and really struggles every time it gets close to the resistance level at 0.6435. Therefore, I still would look for short trades today, either from 0.64325 or following a strong break below the lower channel trend line, and again, we see a divergence with a bearish AUD which helps the bearish case here. Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.

Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.

Concerning the NZD, the Governor of the RBNZ will be holding a press conference about the Financial Stability Report at 10pm.