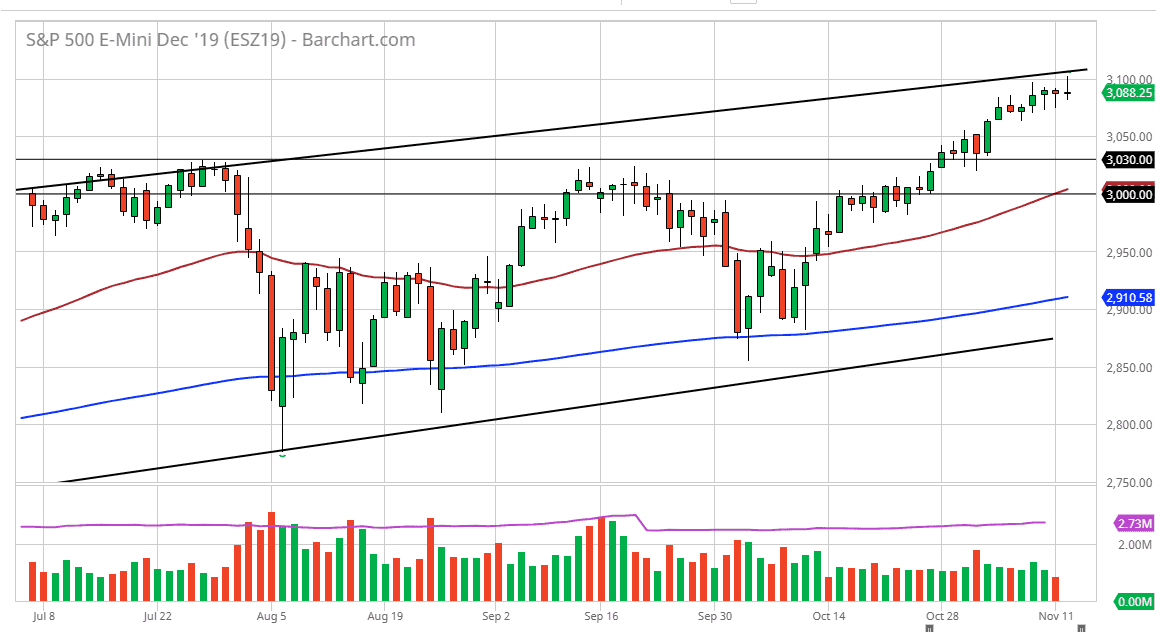

The S&P 500 went back and forth during the trading session on Tuesday, reaching above the 3100 level initially before pulling back. At this point, the market looks likely to chop around in this general vicinity, as we have seen a lot of noise at this area, and at this point it looks as if the 3100 level continues to be a major barrier that will take a lot to get above. If the market were to break above the top of the shooting star, that could be a sign that the market is going to go much higher. Based upon the previous ascending triangle, the market should in theory go to the 3200 level.

Looking at the shooting star, it’s likely that we could drop but I also recognize that the hammer from both Monday and Friday suggest that there could be support. If we were to break down below the bottom of the couple of hammers, that would be an extraordinarily negative sign and could send this market down to the 3050 handle, possibly the 3030 handle after that. Beyond there, there is also the 3000 level, which is a large, round, psychologically significant figure. If we were to break down below there it could change a lot of things but right now, I think any of those level should offer plenty of support in a market that is highly bullish to say the least.

Looking at this market, we are at the top of the channel so it would make a certain amount of sense that we would struggle to go higher. However, if we were to break above the top of the shooting star the market could break out in more of an impulsive type of move. I don’t expect that, but it is a possibility. Pullbacks at this point that show supportive looking candles should offer plenty of opportunities given enough time. I think at this point the NASDAQ 100 will be extraordinarily sensitive to the US/China trade situation, which is in theory going a little better than it had, but at this point it’s likely that the headlines will continue to throw this market around. Longer-term it still looks like it’s bullish though so keep that in mind when trading. Short-term buying the dips probably will be the best way going forward with an eye on the 50 day EMA as a bit of a “floor” in the market.