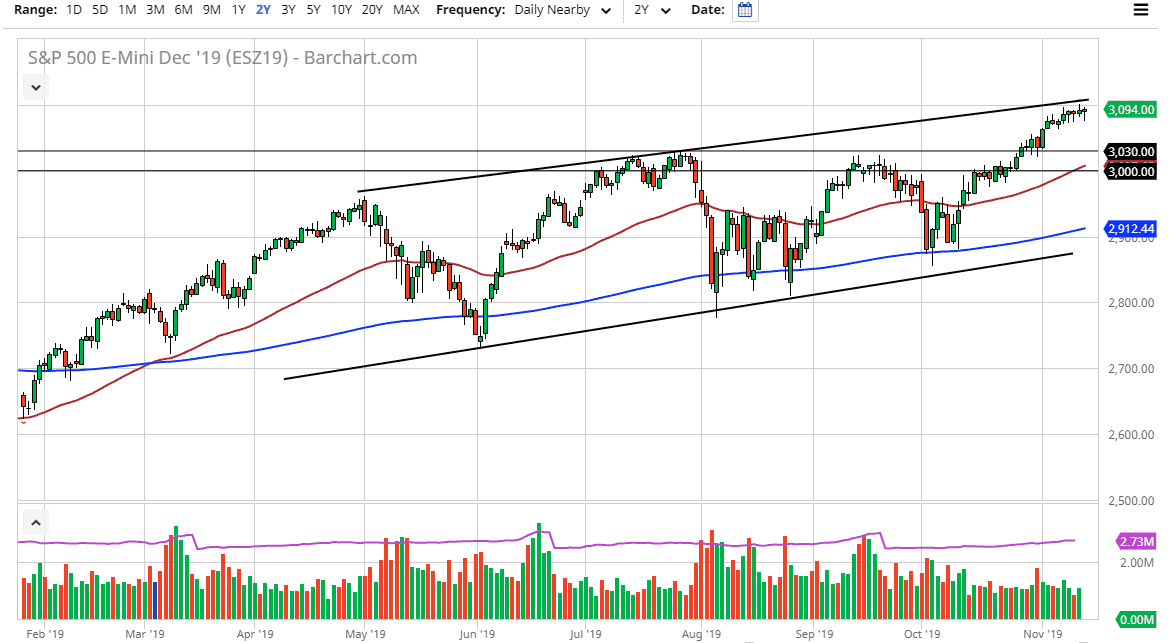

The S&P 500 continues to struggle at the 3100 level but one thing that should be noted is that every time it drifts a little bit lower, the buyers continue to come back and try to pick up a bit of value. At this point, the market looks very likely to continue to see value hunters come in every time it pulls back as it is obviously in an uptrend. That being said though, we need some type of catalyst to go higher and quite frankly I just don’t think we have it at this point. A pullback is very likely but could be welcomed as well. Ultimately, I think that the markets will be looking for value, and quite frankly I think a lot of traders are willing to “pay up” at this point.

To the downside I believe that the 3030 handle is the beginning of the major support underneath that extends all the way down to the 3000 handle. At this point, the market is very likely to find a lot of buyers in this area based upon the previous break out and the fact that we had been in an ascending triangle, which measures for a move to the 3200 level. This is an area that had previously been the top of that triangle so it makes a lot of sense that buyers will get involved.

Overall, the 50 day EMA sloping to the upside helps as well, as it is currently crossing the 3000 region. I think at this point in time the market dips there will be plenty of buyers willing to jump into this market, because quite frankly it’s been picked up every time it’s drifted lower. Breaking higher from here would be a bit difficult, because it would be fighting the top of a channel, and of course the large, round, psychologically significant figure. Ultimately, this is a market that continues to find plenty of momentum to the upside, at least until the last couple of days. This is a sign that we are either going to have to grind sideways for a while or pull back in order find plenty of buyers. I have no interest in shorting this market although I do think a pullback is likely. If we were to break down below the 3000 handle, that could change a few things, but I think the buyers would probably return closer to the 200 day EMA anyway.