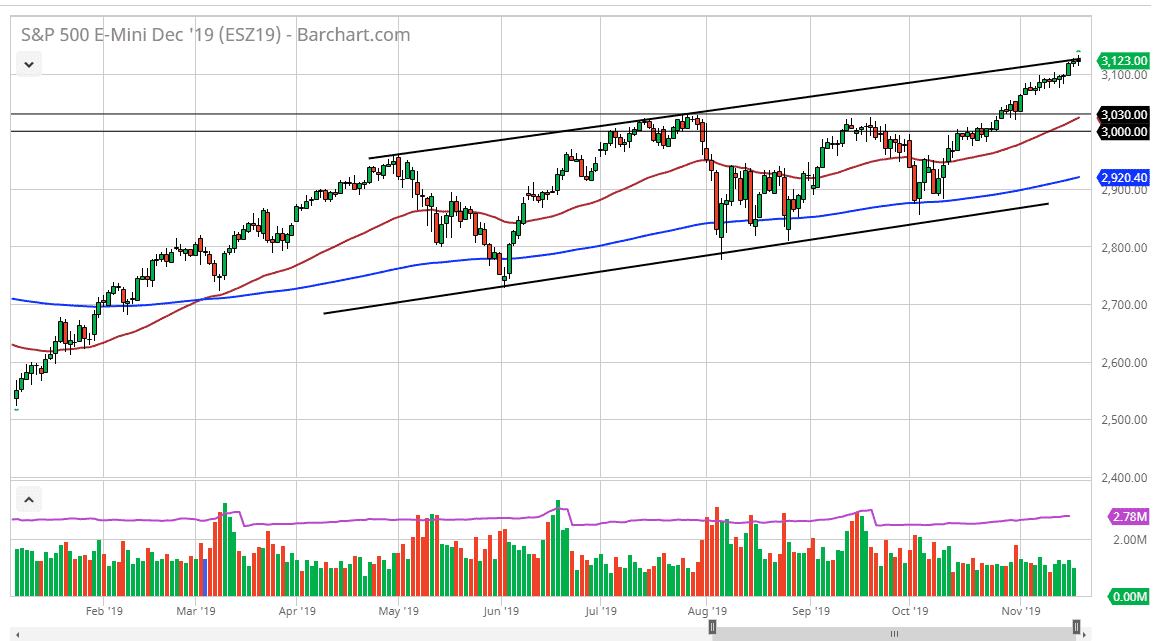

The S&P 500 continues to test the top of the channel that we have been in for quite some time, so if we can break above the top of the candlestick during the trading session on Tuesday, then the market is likely to go much higher. At this point, the 3100 level underneath should continue to offer support, and most certainly the 3000 level will as there is a significant amount of explosive volume to be found on the move above there. At this point, when you look at the chart you can see that there was an ascending triangle that the market broke out of, and that ascending triangle does suggest that we are going to go as high as the 3200 level.

I don’t know if we get there right away, or for we need a pullback in the short term, but either way I am bullish. It isn’t even that I necessarily believe in the economic recovery or the rally in general, just that I recognize that buyers continue to jump back into this market every time we pull back, and you can’t fight that type of scenario. The 50 day EMA is slicing through the 3030 handle, perhaps looking to reach towards the 3100 level. I think at this point it’s only a matter of finding value more than anything else and as we even got Home Depot reporting lighter than expected figures, the S&P 500 simply could not break down, neither could the Dow as they both essentially ended up relatively flat.

With that, it’s obvious that we continue the liquidity injection that sends the market higher, so therefore this should be thought of as a “one-way market”, but that doesn’t mean that you simply buy it right away. If we can break above the highs of the training session on Tuesday, then I would be a buyer. If we can pull back to the 3100 level and bounds, I would be a buyer. If we can break down towards the 50 day EMA and bounds, I would not only be a buyer, but I would become much more aggressive. On breakouts now, I would be a little bit more cautious, but I would also use the NASDAQ 100 as a proxy, as it did outperform. Essentially, it will continue to drag this Index higher with it as the to do move in the same direction over the longer term.