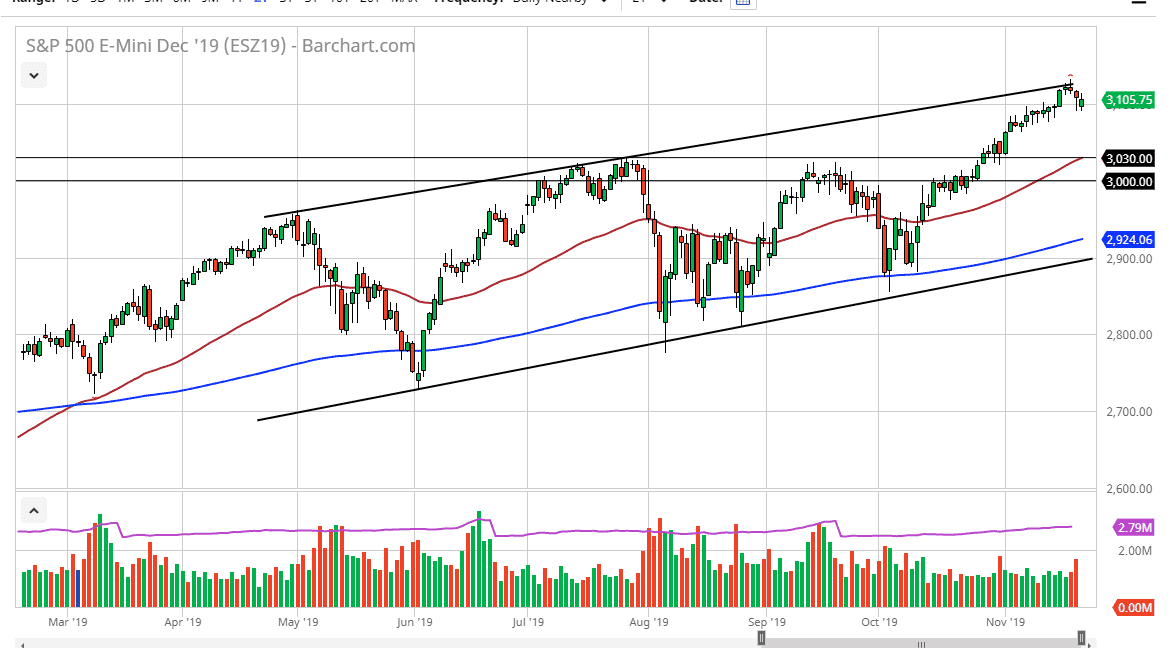

The S&P 500 continues to show signs of confusion at this point, as the market may have gotten a bit ahead of itself. Currently, we are trading towards the top of an overall ascending channel, and that of course is a sign that we are either overbought, or possibly running into structural resistance. Either way, this is a market that probably is going to be better suited if it pulls back. At this point, it would give you an opportunity to pick up a bit of value in a market that is obviously in an uptrend. It doesn’t necessarily mean that you should jump in with both feet but waiting for a bit of value is probably the best way to trade this market.

Looking at the chart, you can see that the 50 day EMA has broken above the 3000 level and is now attempting to break above the 3030 level which was previous support and resistance. That essentially of support “zone” that I think keeps the market somewhat buoyant. A move down to that area could be a nice buying opportunity on a bounce or support of candle, and that’s what I will be waiting for. The S&P 500 of course will be paying attention to a lot of the headlines out there, not the least of which will be the US/China trade situation. That will probably be the biggest driver of the S&P 500 in the short term, and at this point it feels as if the markets are essentially “frozen”, as people are confused as to whether or not we are going to get a trade deal.

If we do not get the so-called “Phase 1” trade, that could be catastrophic for stock markets in general. Ultimately, this is a market that will be very reactive to headlines, and quite frankly when I see this market break down and going to be looking for value underneath. I don’t think we are going to see a significant break down, but even if we do it’s not until we break down below the 200 day EMA which is closer to the 2925 level that I would be worried about the overall uptrend. A certain amount of patience will be needed in order to take advantage of the S&P 500 trend, buying appear doesn’t make any sense as it is far too overextended in the short term.