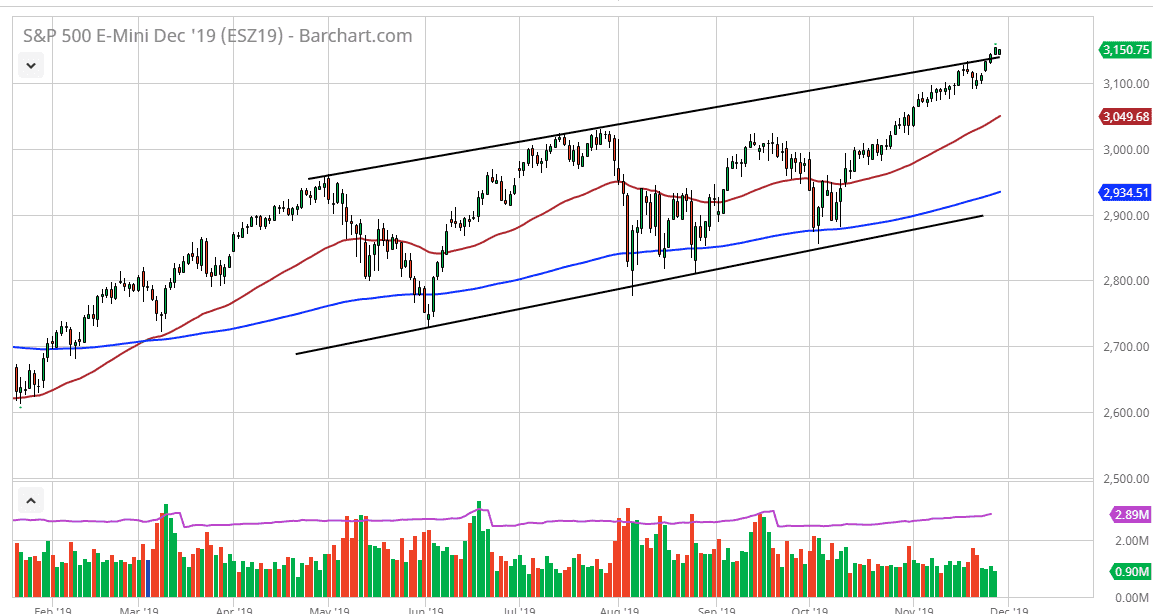

The S&P 500 has gapped a little bit lower at the open on Thanksgiving Day, which obviously had the underlying market closed. That being said though, the E-mini futures did trade and the rallied to recapture some of the losses. By doing so, the market is likely to continue seeing upward pressure. Most of the downward movement was due to Donald Trump signing the so-called “Hong Kong bill” put forth by the United States Congress. This angered China, and the markets break out. However, China has not retaliated as of this point, and furthermore you have to start think whether or not they actually can retaliate.

That being said, the markets are in bullish mode for quite a few different reasons, and if the Chinese choose not to retaliate at this point it’s likely that we will continue to see an acceleration of upward momentum. The market seems to have significant support at the 3100 level, and the fact that even angry comments from China couldn’t keep the market down for any significant amount of tight. At this point, the market is likely to go looking towards the 3200 level, which is a significant target based upon the fact that the ascending triangle measures for that move that we had broken out of recently. At this point, I’m a buyer of dips and have no interest in shorting this market whatsoever.

Whether or not we can break above the 3200 level is a completely different question, but it should be noted that it’s only 50 points away. Quite frankly, if we get good news out of the US/China trade talks, that could happen in a single session. I think at this point pullbacks to the 3100 level will more than likely be supported, just as the 50 day EMA underneath will be. 3000 is your final “line in the sand”, and if we did break down below there then we would have to reevaluate a lot of things but right now it looks like the market is most certainly focused on the upside rather than the down. Keep in mind that the Americans were trading the underlying cash index during the day, so there wasn’t a lot of volume but at this point there hasn’t exactly been a major meltdown when there certainly could have been. That in and of itself is a very bullish sign.