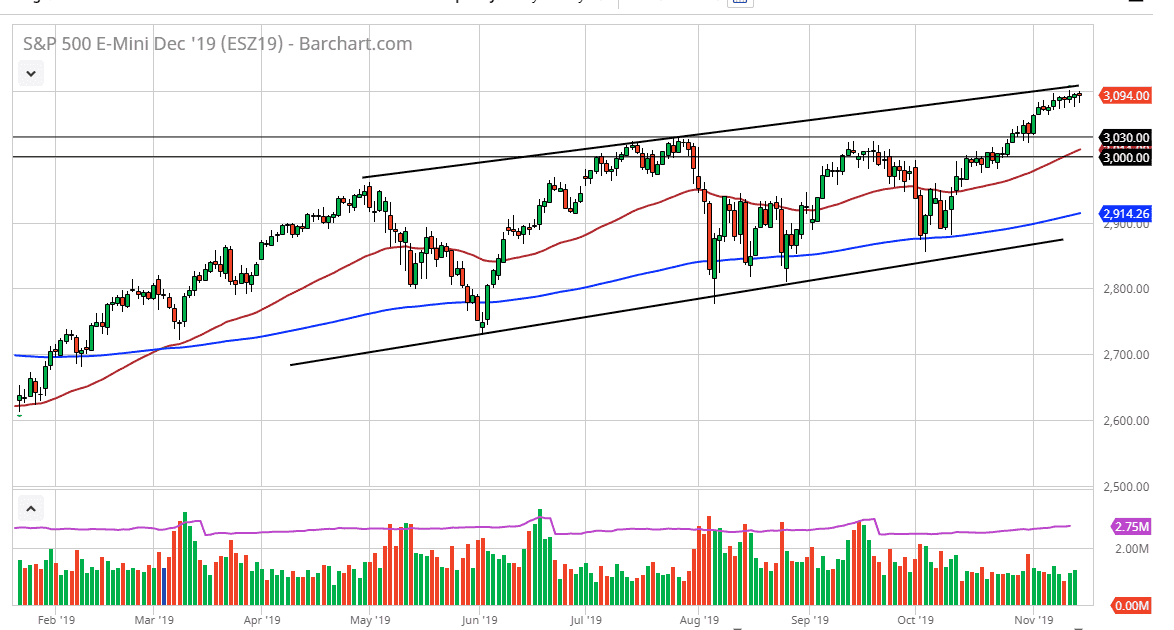

The S&P 500 has done absolutely nothing over the last week, as we continue to see the 3100 level offer significant resistance. That is an area that should continue to be difficult to get above, but if we do break above there then it could signal that the market has finally digested all of the gains necessary to continue the move higher. Ultimately, we could pull back from here I think at that point stepping to the side and allowing the market to offer more value is probably the best way to be.

On a pullback I believe that there will be plenty of support near the 3030 level, and then possibly the psychologically significant 3000 handle. The 50 day EMA is going to offer a lot of support in that area as well, so quite frankly I think it makes sense that this area will attract a lot of attention. If the market was to break down below the 3000 handle, then things could change been in the meantime I think that is essentially your “floor” in this market, as it has been so bullish. Even if we did break down below there, I think that sitting on the sidelines probably still works out in your favor as the 200 day EMA will then be tested.

I recognize that it would be a significant fall from there, but at the end of the day this is something that we have seen more than once. I suspect that there is a lot of momentum underneath that is trying to send this marketplace higher, but we may need to find enough of a pullback in order to get involved. In general, this is a market that I think will continue to be based upon liquidity measures like it has been over a decade, and as the Federal Reserve is on the sidelines it’s likely that stock markets will continue to go higher as there is no other alternative.

Let’s make this plain and straight here: we have made a “higher high” and have been relentless to the upside. It is because of this that you cannot short this market, even if you happen to absolutely not the next 20 points are lower. By being patient, you can participate in what has been a very obvious bullish trend. Breakouts have to be assumed to be true, but again value will always be preferred.