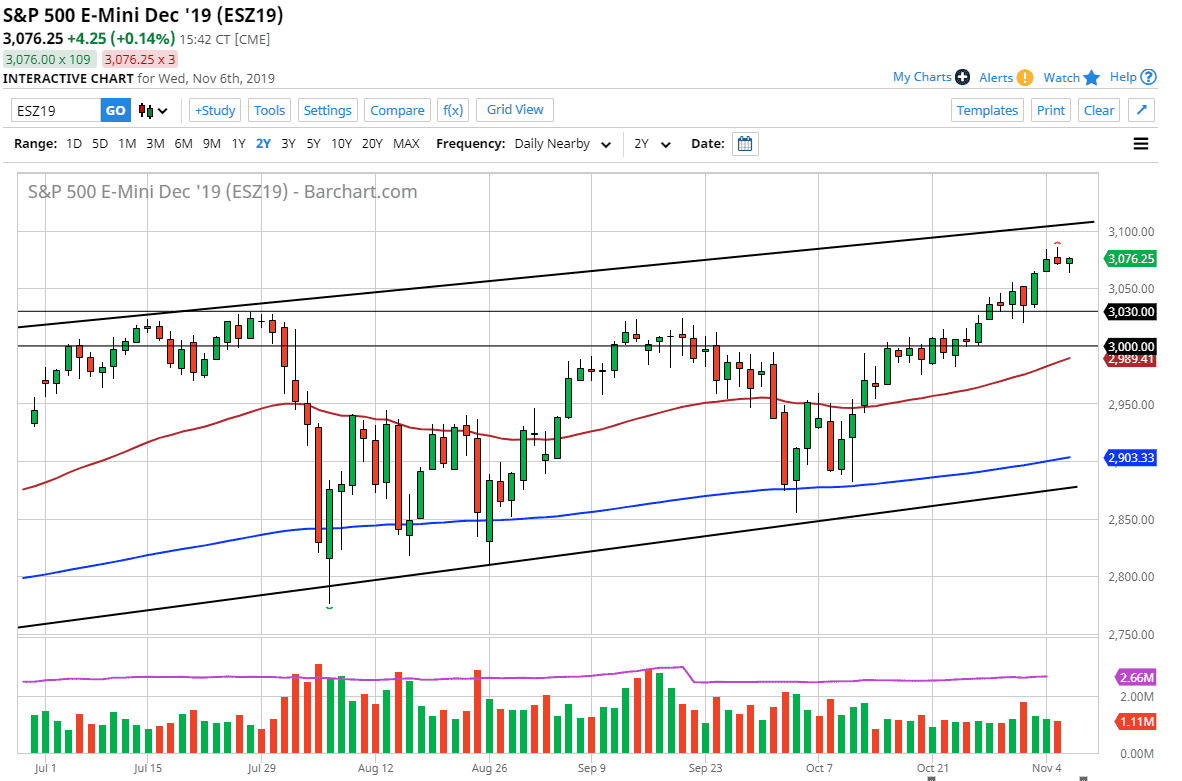

The S&P 500 initially fell during the trading session on Wednesday but turned around to form a nice-looking hammer in order to show underlying resiliency and strength. Ultimately, the S&P 500 is getting a boost due to the fact that the rest of the world is such a mess. In other words, money is flowing into American company simply because “there is no alternative.” At this point, it looks like dips will continue to be bought, and that makes sense considering that we have recently broken out to the upside.

Now that the Federal Reserve is on the sidelines, traders can begin to focus on fundamentals, and it should be noted that the recent earnings season has been relatively good. The fact that we got the shock of the US/China trade pact not been signed in Chile this month and the market turn right back around tells just how much strength there is underneath. At the 3050 level, there is a certain clustering of support, just as there will be at the 3030 level, and then again at the 3000 handle.

The 50 day EMA is currently testing the 3000 level and is set to break above there, offering a bit of a “moving floor.” To the upside, the top of the channel is at the 3100 level so don’t be surprised if we still see some type of pullback, but it should be thought of as a buying opportunity. Quite frankly, this is a market that you by every time it dips, and you eventually make money. I think traders are dangerously complacent, but it is the market that we find ourselves trading and that is the only thing that matters, price.

Looking at the chart, if we can clear the 3100 level it would bring in a new phase of impulsive move to the upside, offering a nice leg higher but clearly one that will need to pull back sooner or later. I like the idea of buying the dips between now and then though, because the resiliency shown by the S&P 500 has been quite impressive. It seems like just yesterday we were down at the 2900 level, wondering whether or not the 200 day EMA would hold. Since then, we’ve seen a nice grind higher as the Federal Reserve forces people away from yields in the bond market and into the S&P 500.