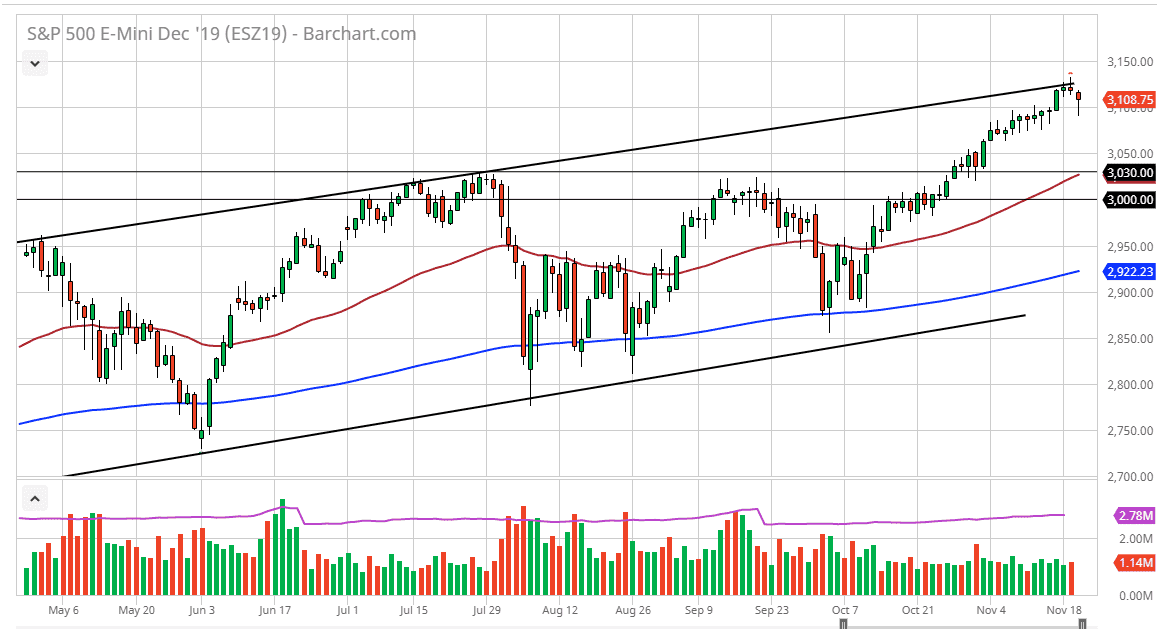

The S&P 500 has sold off initially during the trading session on Wednesday, reaching down below the 3100 level before snapping back to the upside. After hours, Pres. Trump has suggested that more tariffs are possible in December, as the Chinese have not stepped up to the level of reciprocity that he demands. At this point, the S&P 500 has been a bit overdone and it should be pointed out that the shooting star that formed on Tuesday was a right at the top of the overall channel, and at this point it’s likely that we will eventually get a pullback that could offer some value.

The 50 day EMA is crossing the 3030 level, and that’s an area that I think will continue to be crucial. At this point I’d like the idea of buying down in that area on some type of bounce as not only the 50 day EMA will attract a lot of attention, so will the previous action at that level. In fact, I believe there is a bit of a support” zone” down to the 3000 handle, so I don’t have any interest in trying to fight that behavior.

Remember, you should be looking for value in a market that has been so bullish, so at this point in time it’s likely that the value hunters will continue to return, and even if we do break out above the top of the candlestick for the Tuesday session, I would be lying if I told I was excited about that. It could be an impulsive leg higher, but an impulsive leg higher can find a lot of trouble if it’s not careful. The market has been overbought for some time and therefore I don’t have any interest in trying to “pay up” at these high levels if I can avoid it.

If we were to break down below the 3000 handle, that could bring in a much deeper pullback, perhaps down to the 200 day EMA, but I think it’s a bit unlikely to happen. With that being the case, I like the idea of buying dips, but I also recognize that if we give up 3000, it’s likely that we could see further trouble. Based upon the ascending triangle underneath, the target longer-term is for 3200, but I don’t think we need to get there overnight. Because of this, it’s my longer-term target.