The S&P 500 rallied a bit during the day on Monday, to continue the move that we had seen on Friday. Ultimately though, this is a market that will probably pull back a bit to find value hunters jumping back in. The move has been rather strong, but not necessarily based on cyclical stocks. That isn’t necessarily the best look, although certainly it will drive the E-mini contract higher regardless.

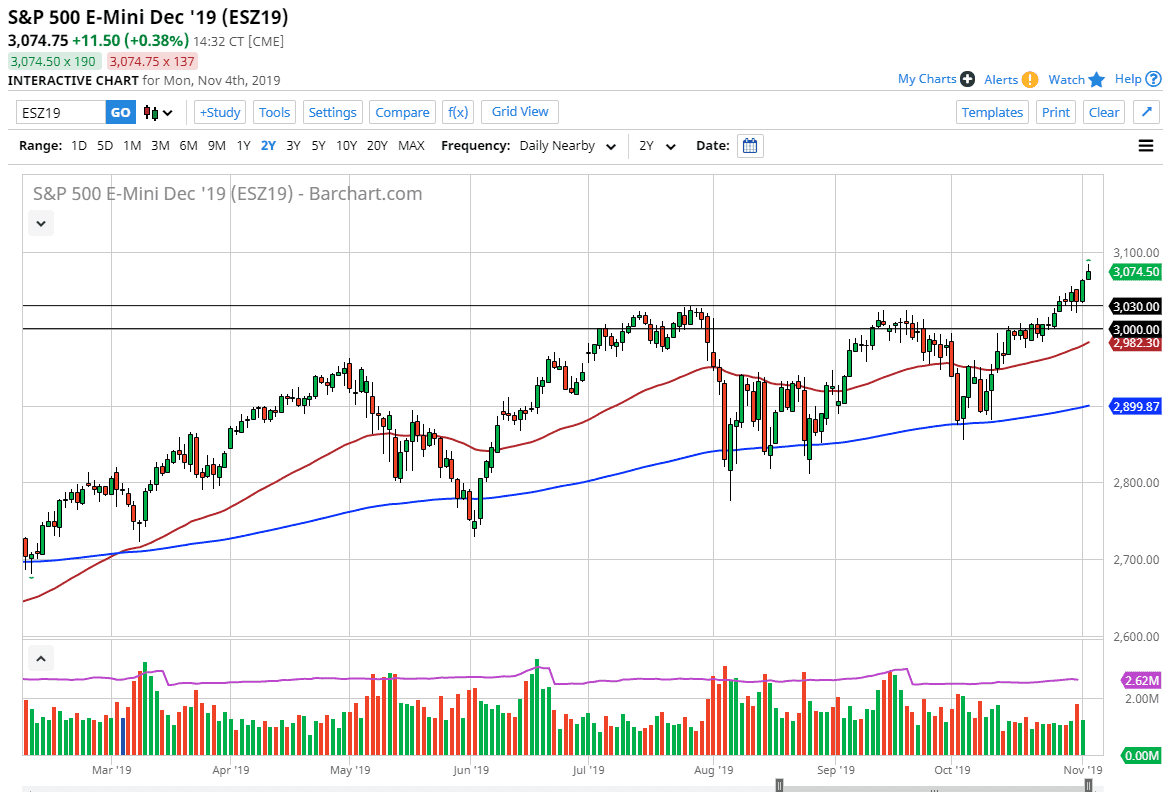

Looking at the chart, I believe that the 3030 level is massive support and should attract a lot of attention, just as the 3000 level will be. Underneath there, there is a 50 day EMA indicator starting to turn higher, and therefore I think it’s only a matter of time before buyers jump in and try to take advantage of what I think will be thought of as “cheap pricing.” Ultimately, we could go higher, but I suspect that the 3100 level will offer a bit of psychological resistance.

One thing that does suggest that a pullback of becoming is the fact that about half the gains were given up towards the end of the day. That isn’t necessarily the most bullish of signs, but ultimately, I think the market will take advantage of lower pricing regardless. After all, we have most certainly broken out to the upside and kicked off what should be thought of as an ascending triangle. That ascending triangle measures for a move all the way to at least 3200 but that doesn’t mean that we have to get there tomorrow. I think that this will be a long and difficult process, driven by headline fears and anxiety, as per usual. Algorithms continue to dominate the markets as well, so be aware that some days, much like Monday, are going to be driven by a lot of back and forth ping-pong action.

Ultimately, this is a market that is in an uptrend and that’s the only thing that you should be concerned about at this point. That being said though, picking the right entry point is going to make a huge difference as the where your returns end up on the spectrum of possibility. I do believe that selling is all but impossible but if we were to break down below the 50 day EMA history has shown us that the market will almost certainly reach down to the 200 day EMA next.