The S&P 500 went back and forth during the trading session, initially rallying due to the idea that the Americans and the Chinese both are getting ready to cut tariffs in order to push the trade war going forward. This of course was very bullish, and traders jumped all over the market. However, there are reports that some within the White House are waffling on the idea, and it’s not a “done deal.” In other words, the market may have gotten ahead of itself so it will be interesting to see how this plays out next. This shows just how sensitive the S&P 500 is going to be to the US/China trade situation.

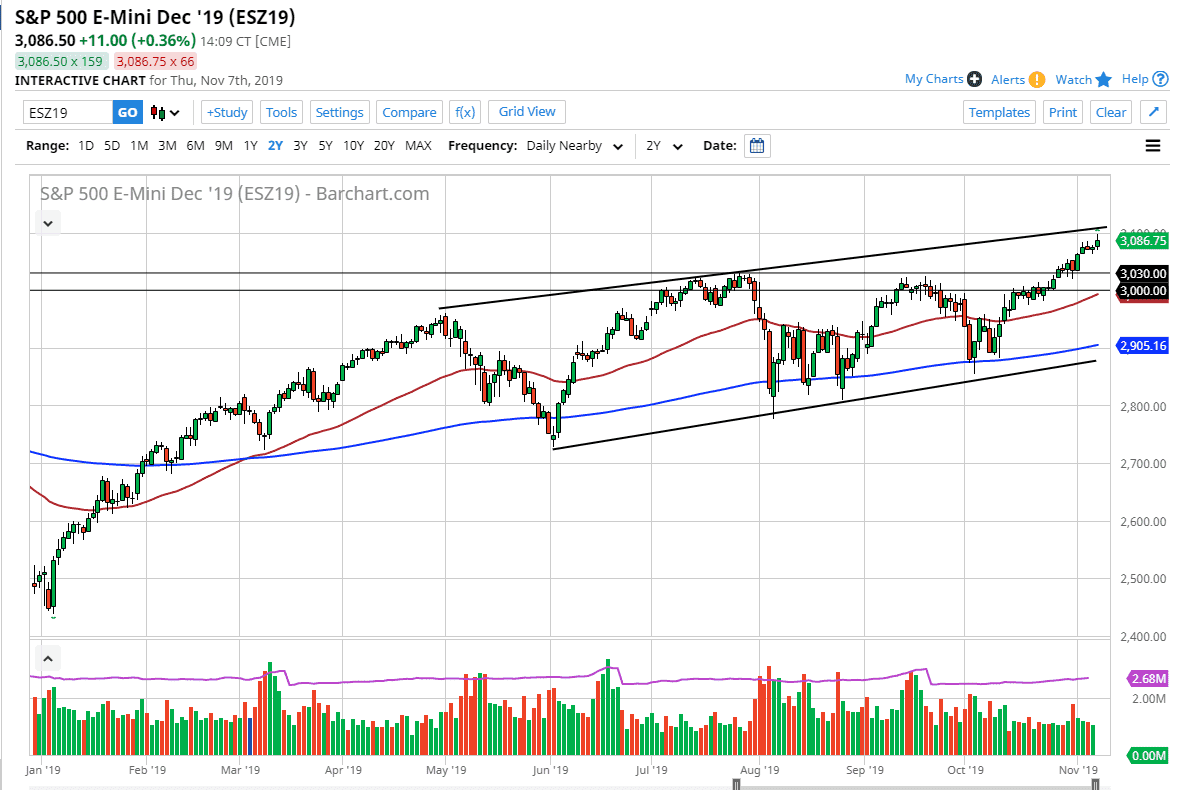

By forming a shooting star, this shows just how overextended and perhaps soft this market is. It’s very possible that we drift down to the 3050 level to find buyers, perhaps even lower than that. The 3030 level would be the next support level, followed by the extraordinarily psychologically important 3000 handle which also is attracting the 50 day EMA which is tilting much higher. At this point, I suspect that’s probably as far as we pullback, and would only need some type of good headline coming out of the US/China situation to turn things around.

All things being equal though, this market is at the top of the overall channel, so we are a bit extended there as well. The 3100 level offers massive resistance but based upon the ascending triangle that we have recently broken out of, the targets actually going to be closer to the 3200 level. That doesn’t mean that we get there right away, and quite frankly it could take several weeks for that matter. It’s just a target, and time does not come into consideration.

That being said though, if we were to break above the top of the shooting star, basically the 3100 level, then the market will enter another impulsive move to the upside that people will be looking to take advantage of. That is my least favorite trade though, because at this point the market is already a little overbought, so I prefer a pullback that offers value for traders to take advantage of. In general, I look at those three major value propositions underneath as areas to try to find hammers or impulsive green candles at.