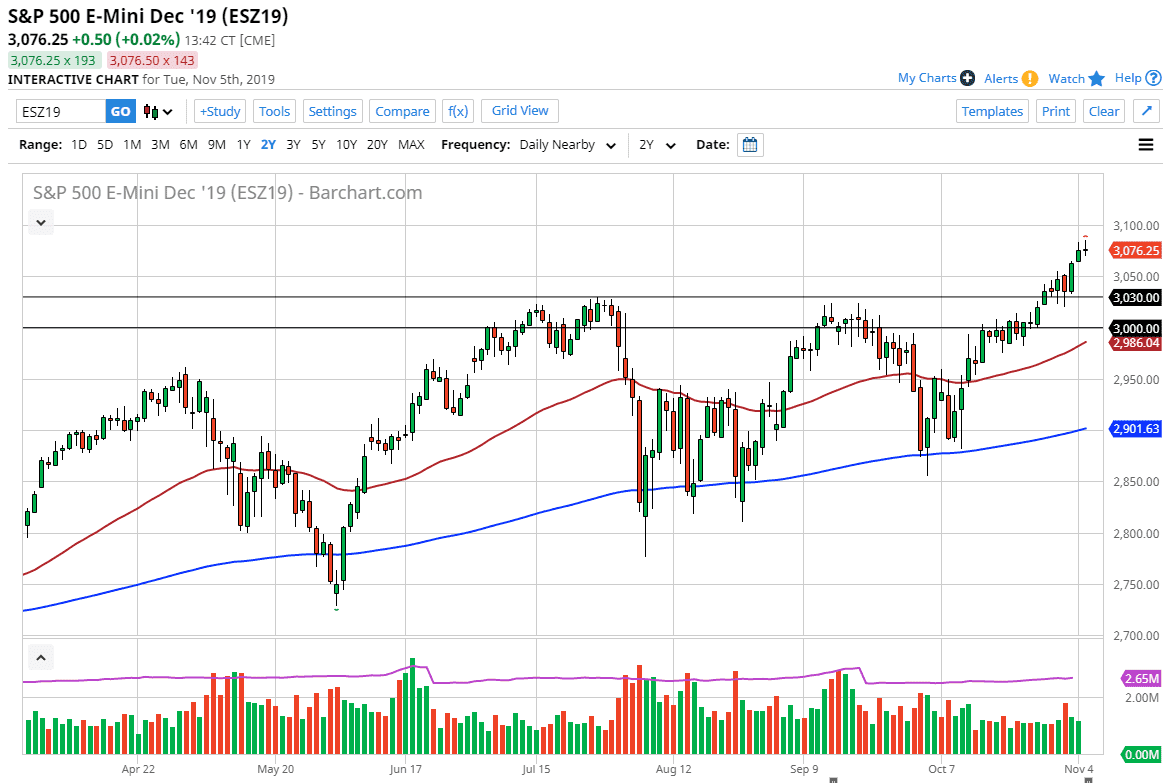

The S&P 500 went back and forth during the trading session on Tuesday, showing signs of momentum running out. Because of this, it’s likely that we will get some type of pullback as the market has gotten a bit ahead of itself. The market could very well reach towards the 3050 level, and then possibly the 3030 level after that. At this point, the market has broken out a bit but continues to have to respect the idea of gravity, meaning that we can’t simply go straight up in the air without pulling back.

I think that the market is likely to pull back in order to offer a bit of value for traders underneath, and it’s likely that we will continue to see buyers jump in and out, as the markets continue to focus on the fact that the US is outperforming the rest of the world. We had recently broken above the ascending triangle, and it’s likely that we could go as high as the 3200 level.

At this point, the market should find plenty of support underneath, and of course the 3000 level will be crucial as well. The 50 day EMA is starting to reach towards that level, and it’s likely that the buyers will return in that area. Signs of support in that area or of bounce is an opportunity to start buying. The alternate scenario of course is that we can break above the top of the candlestick for the trading session on Tuesday, and that would unleash the market reaching towards the 3100 level.

At this point in time it’s not until we break down below the 50 day EMA that I would be concerned about the market, and even then, we have seen a lot of buying pressure at the 200 day EMA previously. There is plenty of support underneath due to order flow anyway, and of course the Federal Reserve although on pause, certainly won’t get in the way and that should continue to help stock markets rally in the end. I have noticed in shorting though, and therefore on simply looking at pullbacks as an opportunity to pick up a bit of value in a market that has further to go based upon the ascending triangle that we have so obviously broken through. It’s simply a matter of trying to find that value and taking advantage of it.