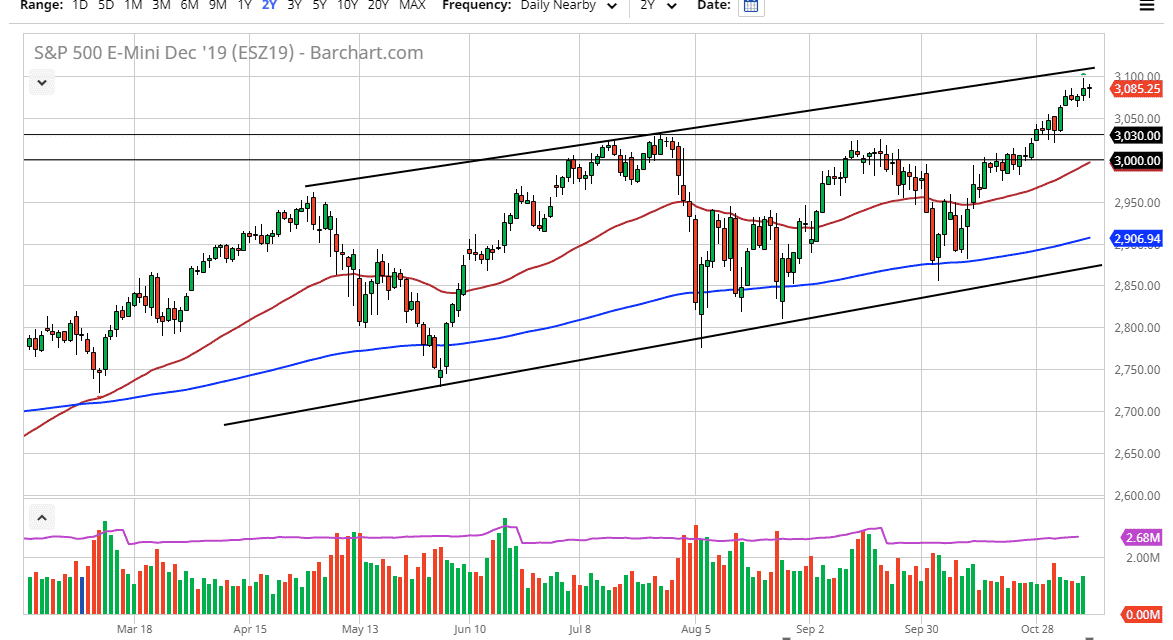

The S&P 500 has found quite a bit of choppiness during the trading session on Friday, as we are getting close to the 3100 level. This is an area that of course has a certain amount of psychological importance pulled into due to the round figure. It’s very likely that the market will continue to struggle with this area not only due to the fact that it is a large figure, but it is also at the top of the uptrend in general, and as a result there are a couple of different reasons to think that this market may pullback.

The market has obviously broken out to the upside, so the question now is whether or not we pay attention to the uptrend in general, or if we take advantage of the breakout of the ascending triangle. The ascending triangle being broken to the upside of course suggests that perhaps the market could go as high as 3200, and I do think that it’s only a matter of time before the market reaches that level. That being said, it will probably take a certain amount of momentum to make that happen. I think at this point we are more likely to see a bit of a pullback in order to offer a bit of value.

Underneath, the 3050 level will of course offer support, just as the 3030 level will. Below there, the 3000 level of course is crucial, so I think at this point it’s likely that the large, round, psychologically significant figure will be paid close attention to, and therefore it’s obvious that there are a lot of reasons to think that somebody would be paying attention to at that level. Furthermore, the 50 day EMA underneath is starting to reach towards the upside, so that being seen at the 3000 level it’s very likely that the market could form a bit of a short-term “bottom.”

The alternate scenario of course is that if we can break above the 3100 level, it’s likely that the market will just go straight to the 3200 level in a very parabolic move. It's very likely that the market will continue to go higher, the question now isn’t so much as whether or not it will go higher, but whether or not it will do so directly, or after a pullback. I prefer the latter of the two options.