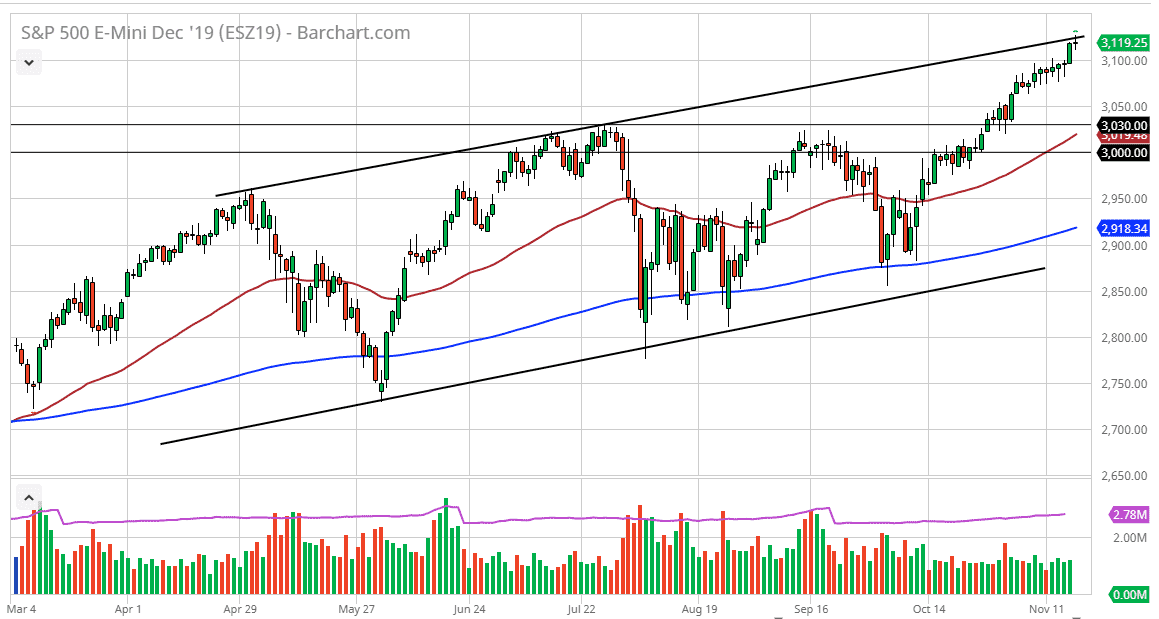

The S&P 500 has gone back and forth during the trading session on Monday, showing signs of exhaustion at the top of a larger channel. If we can break above the top of the range for the trading session on Monday though, that would be the beginning of an impulsive move higher, perhaps sending the markets towards the 3200 level next.

The 3200 level of course is based upon the ascending triangle underneath it has been broken to the upside, and now it looks likely to fulfill that sooner or later. That being said though, I would prefer to see this market pull back a bit so that I can pick up a bit of value, as the market has gotten a bit ahead of itself. The 3100 level should of course show a lot of interest as it was the recent breakout point, but even if we were to slice below there, I think the market has plenty of support underneath.

Looking at this chart, the 50 day EMA is starting to go towards the 3030 handle, and at this point I think there are plenty of buyers at that level, but it’s going to be very difficult to reach down towards that area. If we were to break above the top of the candlestick that would be an impulsive move higher and although I would feel pressured to buy this market, as it has been so bullish, I still prefer value at this point.

Keep in mind that the S&P 500 continues rally based upon liquidity measures, and therefore you should be paying attention to central banks. Furthermore, if the market was to have a massive impulsive move higher, the pullback will of course be very drastic as well. All things being equal though, it’s likely that the market will continue to go higher but only based upon some type of value proposition. After all, the “easy money” has already been made so because of this I think it’s only a matter of time before buyers commit to take advantage of what has been a very strong of trend. If we can break above the 3200 level, then it’s very likely to continue a bigger leg higher. It’s not until we break down below the 200 day EMA that I would be concerned about the overall uptrend. That is just above the 2900 level, which obviously isn’t going to get hit anytime soon.