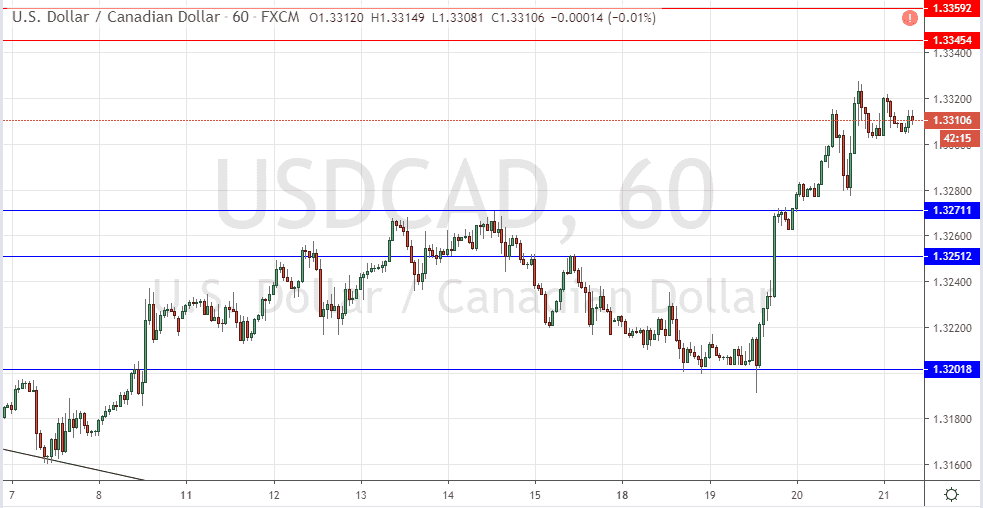

USDCAD: Bullish above 1.3271

Yesterday’s signals were not triggered, as there was no bearish price action when the two resistance levels at 1.3300 and 1.3320 were reached.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered prior to 5pm New York time today only.

Long Trade Ideas

⦁ Long entry after the next bullish price action rejection following the next touch of 1.3271 or 1.3251.

⦁ Place the stop loss 1 pip below the local swing low.

⦁ Adjust the stop loss to break even once the trade is 20 pips in profit.

⦁ Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

⦁ Short entry after the next bearish price action rejection following the next touch of 1.3345 or 1.3359.

⦁ Place the stop loss 1 pip above the local swing high.

⦁ Adjust the stop loss to break even once the trade is 20 pips in profit.

⦁ Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

I wrote yesterday that although the picture was much more bullish the area at about 1.3350 above has acted as long-term resistance, so it was likely to be a very pivotal area again if reached.

This call is still valid as although we see continued upwards movement by the price, it is faltering a little as it gets to within 20 pips or so of 1.3350. However, the Canadian Dollar is still relatively weak as markets are still selling it after the Bank of Canada indicated some increased dovishness earlier this week on rates. This may change later today as the Governor of the Bank of Canada will be speaking and could address this issue.

I would take a bullish bias over the short-term as long as the price holds up above 1.3271, but a bearish reversal at 1.3345 or higher should be taken very seriously as that could produce a medium-term bearish reversal which could be nicely profitable if traded short, and I would take any such short trade which set up like this. Regarding the CAD, the Governor of the Bank of Canada will be speaking at 1:40pm London time. There is nothing of high importance due today concerning the USD.

Regarding the CAD, the Governor of the Bank of Canada will be speaking at 1:40pm London time. There is nothing of high importance due today concerning the USD.