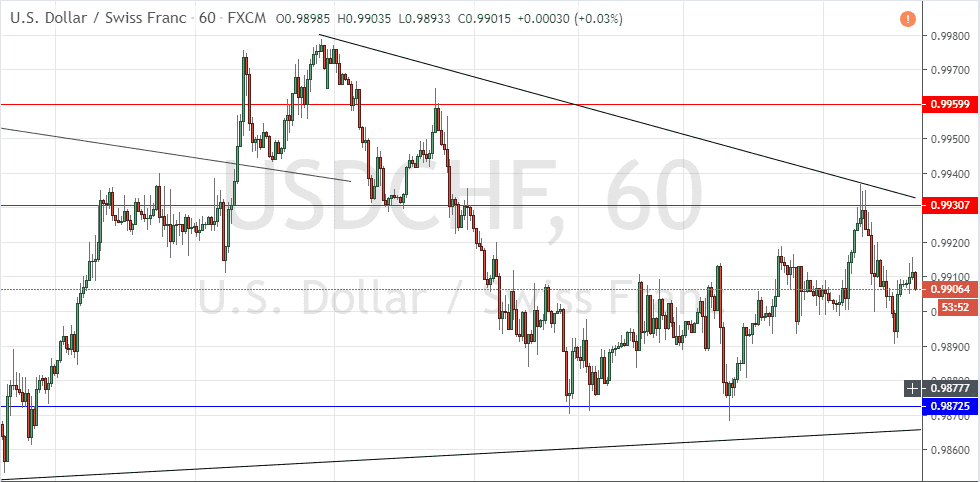

USDCHF Analysis: Narrowing triangle formation

Yesterday’s signals were not triggered, as there was no bearish price action when the two key resistance levels were reached.

Today’s USD/CHF Signals

Risk 0.50%.

Trades must be entered between 8am and 5pm London time today only.

Short Trade Ideas

⦁ Go short following a bearish price action reversal upon the next touch of 0.9931 or 0.9960.

⦁ Place the stop loss 1 pip above the local swing high.

⦁ Adjust the stop loss to break even once the trade is 20 pips in profit.

⦁ Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

⦁ Go long following a bullish price action reversal upon the next touch of 0.9873 or 0.9820.

⦁ Place the stop loss 1 pip below the local swing low.

⦁ Adjust the stop loss to break even once the trade is 20 pips in profit.

⦁ Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote yesterday that I saw the day’s pivotal point as 0.9924 or perhaps 0.9925. If the price could break above that level and get established there, we should see another upwards thrust, so I would take a weak and cautious bullish bias until 0.9960 if this scenario played out. This was a good call as 0.9925 was exactly the pivotal point of the day: it held and produced a downwards movement.

The price is currently going nowhere and is caught just halfway between the nearest support and resistance levels. The indecision is further emphasised by the consolidating triangle formation which dominates the price chart shown below. Therefore, I take no directional bias and see a long from 0.9873 or a short from 0.9931 as equally valid trades which may set up today. There is nothing of high importance due today concerning the CHF or the USD

There is nothing of high importance due today concerning the CHF or the USD