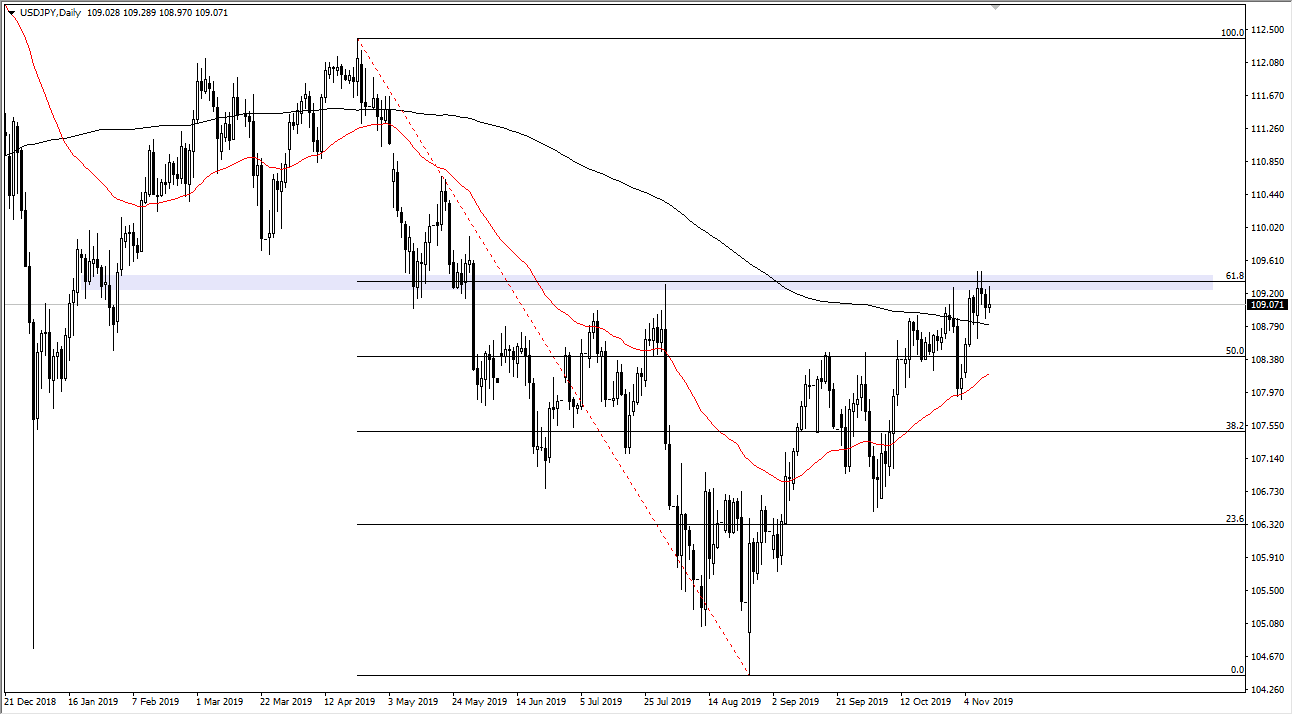

The US dollar has tried to rally during the trading session on Tuesday, reaching towards the ¥109.50 level yet again. At this point, the market has formed a bit of a shooting star, but we are sitting on top of major support as well. Ultimately, the market is going to be paying attention to the 200 day EMA underneath, which is currently just below the ¥109 level.Ultimately, the area features the 61.8% Fibonacci retracement level as well, at the ¥109.50 level that extends to the ¥110 level. If we were to break above that level, the market is going to continue to go much higher, and at the very least fill that gap above at the ¥111 level.

At this point, I also noticed that the 50 day EMA is starting to reach higher, and it tells me that the market is trying to reach towards the 200 day EMA above. If the market sees the 50 day EMA slice through the 200 day EMA, it is essentially the technical signal known as a “golden cross.” That is typically a longer-term buy-and-hold signal, and at this point it should continue to go higher based upon the longer-term money, but we need to see some type of catalyst to send the markets much higher.

At this point, it has something to do with risk appetite obviously that will move this market. Remember, the Japanese yen is considered to be a “safety currency”, and as a result the US dollar should rally quite nicely against the Japanese yen in that scenario. Ultimately, pulling back does offer a bit of a value play, because it’s obvious that the pair is trying to break out to the upside. That being said, one thing that I am paying attention to is that the S&P 500 is breaking to the upside. At this point, the market is showing signs of strength, and therefore it’s likely that we will get more of a “risk off” move, which is exactly what we are hoping in this market. However, the market was to break down below the 50 day EMA, the market will more than likely go looking towards the ¥108 level, and then possibly even as low as the ¥107 level. At this point though, short-term pullbacks continue to offer short-term buying opportunities. It’s very unlikely that we break down, but pay attention to that 50 day EMA as it can serve as a warning.