The US dollar continues to go back and forth against the Japanese yen as we are dancing around the 200 day EMA. The US/China trade situation has not helped the scenario, because quite frankly the Chinese originally suggesting that the phone call was “constructive” during the weekend between US Treasury Secretary Steve Mnuchin and the Vice Premier of China, only to say later that perhaps things were a bit more pessimistic than thought.

At this point, the 50 day EMA is starting to turn higher, and it is getting ready to close the gap between itself and the 200 day EMA. If it crosses above the 200 day EMA, that is technically a “golden cross”, which of course is a very bullish sign. The 61.8% Fibonacci retracement level is just above, and that of course will attract a lot of attention in and of itself. The ¥109.50 level extends to the ¥110 level, and therefore I think if we were to break above the ¥110 level, then the market would rip to the upside. At this point, the market would very likely go looking towards the ¥112.50 level due to the 100% Fibonacci retracement level.

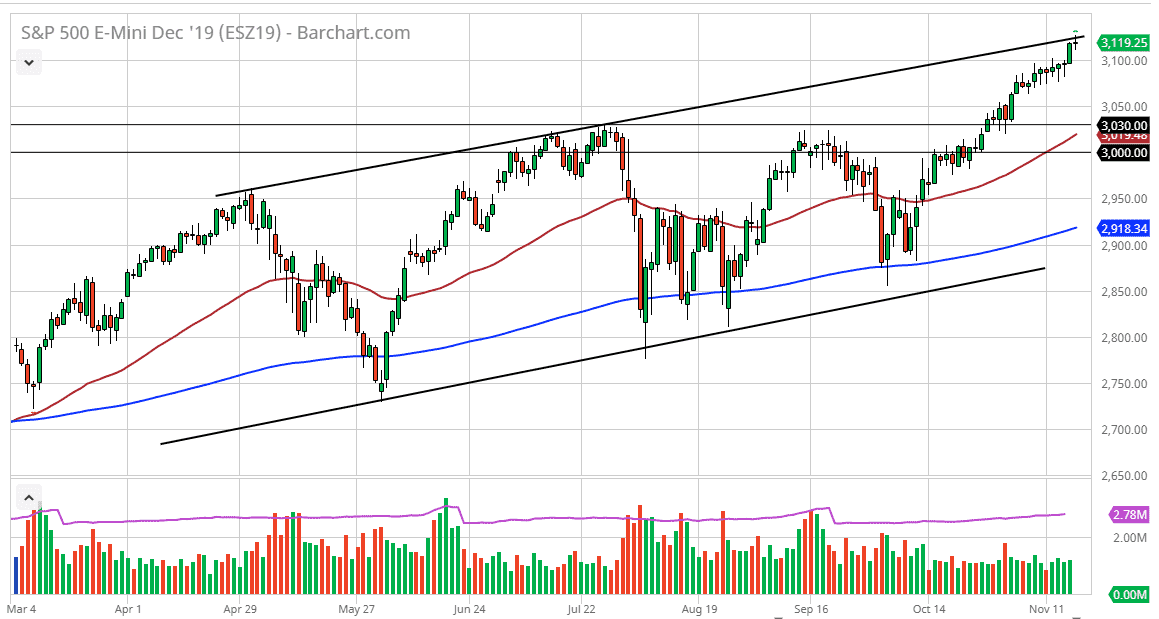

There is a gap between ¥110 and the 100% Fibonacci retracement level closer to the ¥111 level. If the market was to test that area you could probably expect some type of pullback but at this point I think a breakout above the area just above current trading would be significant enough that eventually back Would get sliced through. Unfortunately, this pair is going to be very sensitive to the US/China trade situation, which means there will be plenty of headlines to tossed around erratically and cause headaches for traders around the world. It does look like it’s a “buy on the dips” type of situation, at least so far though. Keep in mind that this pair is highly sensitive to risk appetite so if risk appetite picks up a bit then it would make sense that it would go higher. One of the better tertiary indicators is going to be the S&P 500. While I do believe we go higher, I recognize that simply jumping in with both feet is probably a very reckless way to trade this market. If you can wait, a break above the ¥110 level would be an excellent opportunity to go long.