The US dollar has gone back and forth all day against the Japanese yen on Tuesday as markets have no place to be anytime soon. Because of this, the marketplace has been very difficult to deal with over the last couple of days, and we are compressing, something that typically is a sign that we are going to get a big move. However, I don’t know if that’s the case right now. After all, a lot of what’s moving market in general is the US/China trade noise, and nobody really knows what to make of that at this point. In theory, this market should rally if we get more of a “risk on move” when it comes to the overall marketplace.

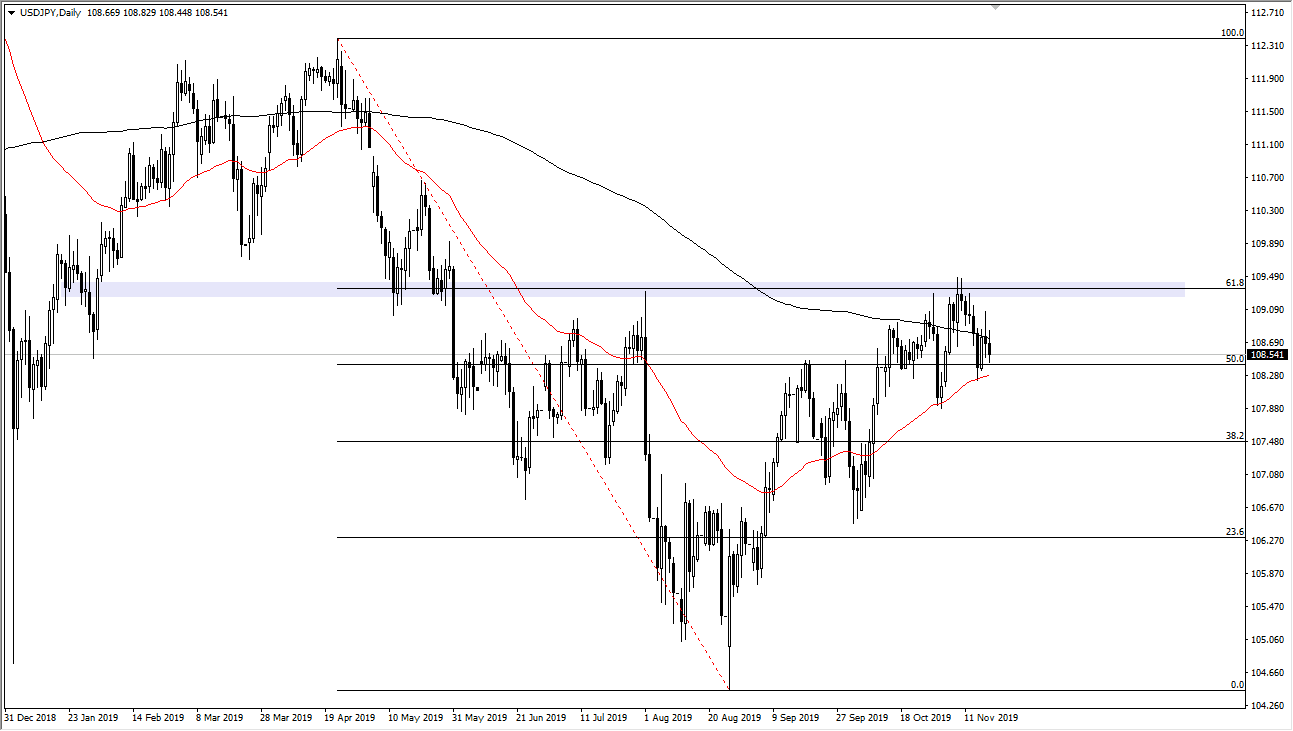

Looking at this chart, the 50 day EMA is starting to squeeze towards the 200 day EMA, and therefore it looks as if we may be getting ready to trying to form some type of “golden cross” which in theory is very bullish and should have people jumping into the market. However, if we do get move between now and then, then you have to follow wherever the momentum goes. What I mean by this is that if we break down below the 50 day EMA underneath, the market probably drops down towards the ¥108 level. To the other side, if we were to break above the 200 day EMA, the market probably goes looking towards the 61.8% Fibonacci retracement level, an area that of course will attract a lot of attention and has already offered significant resistance. In fact, it’s also are we have seen a lot of selling in the past that defined the massive push lower.

The 61.8% Fibonacci retracement level is around the ¥109.50 level, and then extends to the ¥110 level. If we can break above that level, then the market is very likely to go much higher, breaking towards the gap above at the ¥111 level, and then eventually reaching the 100% Fibonacci retracement level at the ¥112.50 region. I do believe that we are more likely to break higher than lower, just based upon what we have seen in the stock market. However, don’t be surprised at all to see a bit of a pullback before we finally build up the necessary momentum to finally make the breakout. Regardless, I would keep my position size relatively small as the choppiness is getting worse, not better.