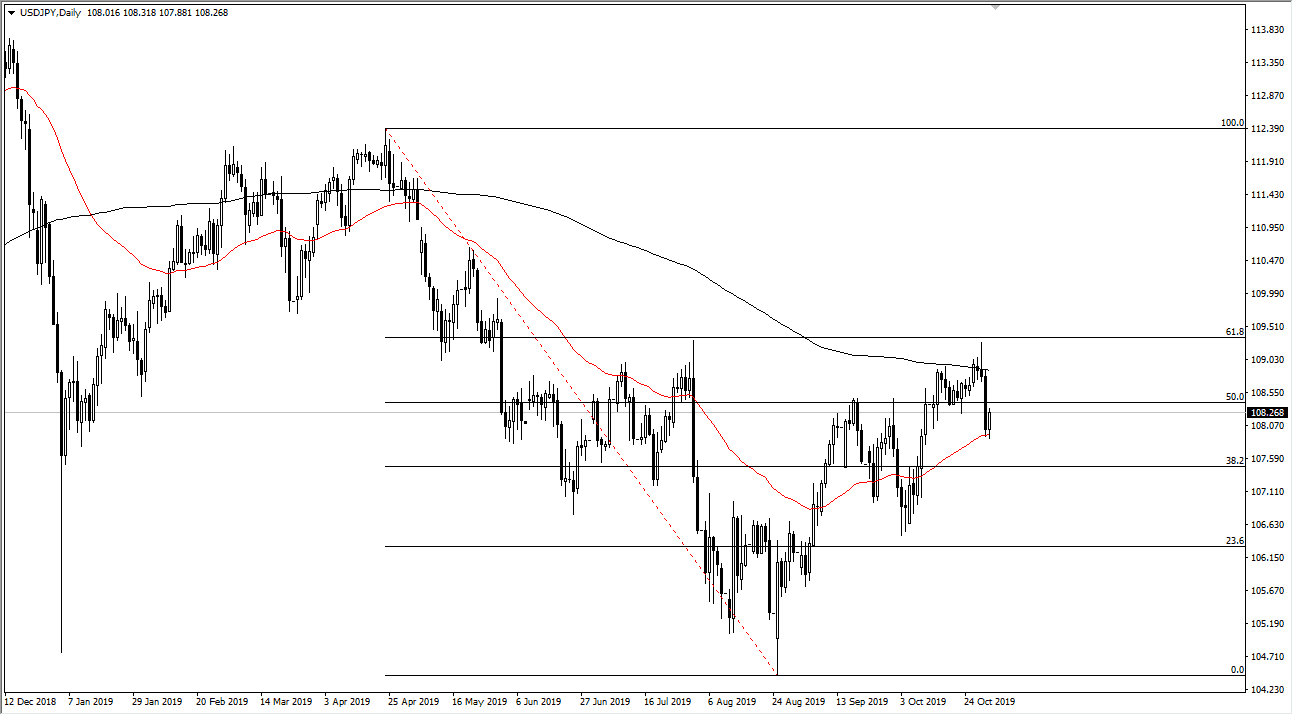

The US dollar bounced a bit during the trading session on Friday, after the jobs never came out better than anticipated. This is the expected reaction, as this pair does tend to rise with risk appetite. The US stock markets did quite well, and as a result they put upward pressure on the US dollar, or perhaps more importantly they put downward pressure on the Japanese yen as it is considered to be a safety currency. With that being the case, the market found the 50 day EMA as a potential launching point, which did in fact turn out to be valid.

That being said, the market has a lot of resistance above, so don’t expect some type of massive rep to the upside. The 200 day EMA is currently trading at roughly ¥109, and at the top of the massive negative candle from Thursday. At this point, the market should continue to find plenty of selling pressure in that area, so the balance will probably be somewhat short-lived. That’s not to say that the market is falling apart anytime soon, just that it is going to be difficult to break out to the upside. Beyond that, there is a lot of resistance not only from the 200 day EMA but from the Wednesday shooting star and then the 61.8% Fibonacci retracement level which is just above. If we were to wipe out the ¥109.50 level, then the market would finally be through a lot of the resistance and could continue to go to the upside. Ultimately, this is a market that will continue to find plenty of reasons to move back and forth and with the S&P 500 breaking out I suspect the buyers will return to this pair given enough time.

To the downside, it’s very likely that the ¥107 level will offer support so if we were to break down below there that would be a very negative sign. More than likely it’s going to coincide with some type of obvious “risk off” situation globally. That being said, it doesn’t look like we are getting that right now, so I like the idea of buying on dips, but I’m not looking for big moves anytime soon, so this is more or less a short-term set up waiting to happen. Given enough time we will get some type of impulsive move, but we still wait.