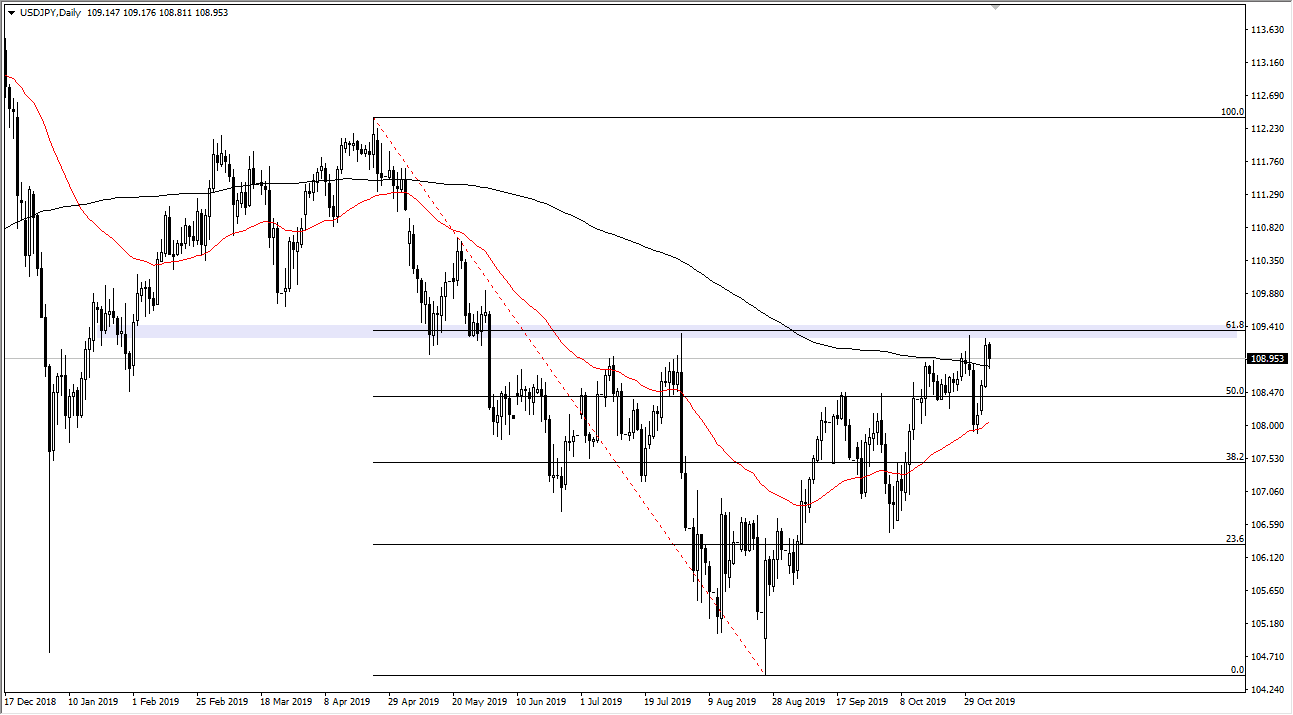

The US dollar continues to find plenty of buyers overall, and recently has tested the crucial ¥109.50 level more than once. By doing so, the market looks likely to continue seeing a lot of volatility, and will continue to press the area. This is the 61.8% Fibonacci retracement level, an area that of course will attract a lot of attention. That being said, we have recently broken above the 200 day EMA which of course is a very bullish sign, and the fact that even though we pullback during the trading session on Friday, we can stay above it is a good sign. With that being the case it’s likely that we will continue to try to grind higher.

I suspect that the market will move right along with the risk appetite of the stock markets, which have been all over the place. That being said, it’s likely that the S&P 500 will break out to the upside and once it does it’s very likely this pair will follow right along. Ultimately, if the market did break down, then this pair could follow right along with it. The 50 day EMA currently sits at the ¥108 level, and therefore I think it is currently the “floor” in the marketplace.

Recently, we have seen a nice turn around to reach towards the highs again. At this point, it’s only a matter of time before this market breaks out from what I see, and it looks as if we are eventually going to break out above that resistance to go much higher. That being said though, the market was to break down below the 50 day EMA, it’s likely that the market could unwind down to the ¥107 level. You can also make an argument for the 50 day EMA is reaching towards the 200 day EMA, thereby crossing above there would be something to pay attention to as it is a “golden cross” in general driving more money into the marketplace. If we were to break out to the upside, the market could go as high as the 100% Fibonacci retracement level, which is closer to the ¥112 level. At this point, it’s likely that the buyers will eventually when the day but expect a lot of noise between now and then. Remember, the Japanese yen is a “safety currency.”