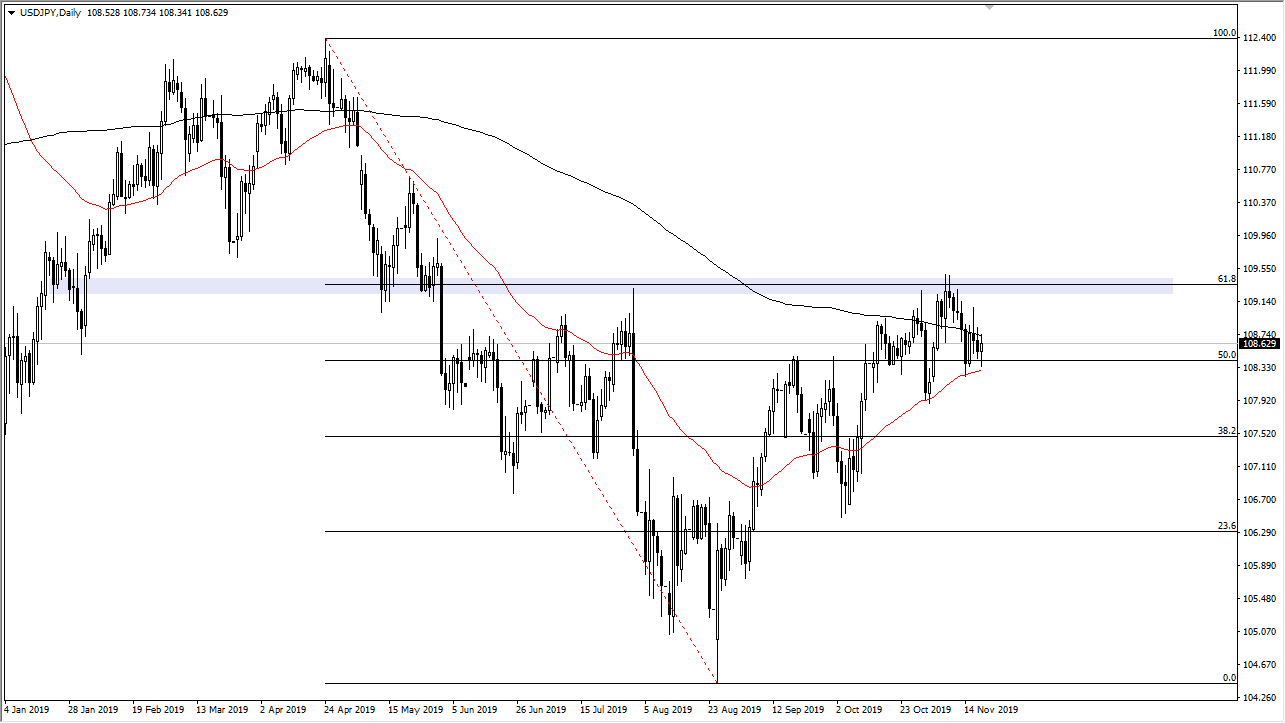

The US dollar went back and forth during the trading session on Wednesday, as we continue to bounce around between the 50 day EMA underneath and the 200 day EMA above. At this point, the market looks very likely to continue going back and forth as there are so many headlines out there that could move this pair as it is so sensitive to risk appetite in general.

The US/China trade situation is without a doubt the biggest thing that is moving this currency pair, as the Japanese yen tends to be thought of as a “safety currency.” In other words, as we get negative headlines, quite often the Japanese yen will gain in strength. On the other hand, if we get positive headlines, most traders will short the Japanese yen, so in this case the US dollar would rally against it. That being said, looking at the chart, a picture is starting to show itself.

The 61.8% Fibonacci retracement level above should continue to be resistance, at roughly ¥109.50 that extends to the ¥110 level. Overall, if we can break above that 50 point range, then the market should go much higher, perhaps reaching towards the gap at the ¥111 level, and then the 100% Fibonacci retracement level which is closer to the ¥112.50 level. That being said, it’s going to take a significant number of bullish headlines out there to send this market higher and breaking through that barrier. In the last couple of months, we have seen this market relentlessly grind higher, but it has been very choppy and erratic, which is a good proxy for what’s going on around the world.

Looking at this chart, to the downside I see the ¥108 level as being supportive, and then I think below there I believe that the ¥107 level also will offer a significant amount of support. If the market was to break down through those levels, it would change everything but, in the meantime, I don’t think it’s very likely to happen. I believe that as soon as we get some type of good headlines out of the US/China situation, this pair will eventually try to break out to the upside. That being said, never underestimate the power of politicians to make things worse, so that of course is something that you need to keep in the back of your mind.