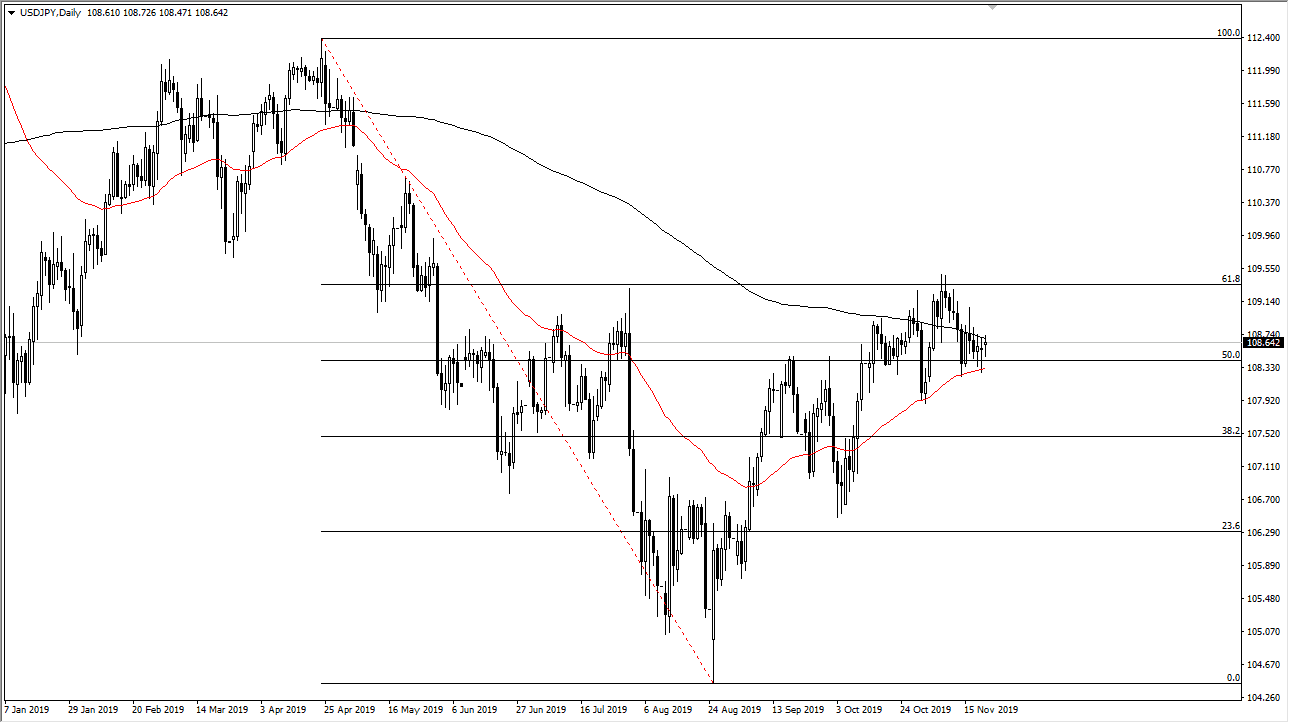

The US dollar initially pulled back a bit against the Japanese yen during the trading session on Friday, but then found support underneath to turn things back around. We are reaching towards the 200 day EMA above, and if we can break above there it’s likely that the market continues to go much higher. The 50 day EMA sits just below, and it should continue to offer support as it has recently. The compression of price is going to continue to drive this market in one direction or the other, but at this point one would have to think that it’s much more likely to go higher than lower, as the stock markets are still trying to break out to the upside.

With this, USD/JPY tends to follow the S&P 500 in general, and it of course looks very bullish. I think the idea of buying dips in this market makes quite a bit of sense, and therefore we should continue to see value hunters come back in. If we did break down below the 50 day EMA, then possibly we drop down to the ¥108 level, and then possibly even down to the ¥107 level. Ultimately, a rally does come with serious issues though.

The 61.8% Fibonacci retracement above is at the ¥109.50 level, extending to the ¥110 level. If we can finally break above the ¥110 level, the market is likely to go much higher, as it will be like a “Beach ball breaking the surface of the water.” In other words, it should spring higher as the inertia gets released. To the downside, I think there are enough support levels that a fall in this pair will probably be somewhat muted. That is very similar to the S&P 500, which has quite a few supportive levels underneath. Because of this, it’s very likely that the market will continue to see buyers underneath, taking advantage of various areas where there has been support and impulsive movements in the past. I have no interest in shorting this market, but I recognize it’s a huge fight just waiting to happen as far as breaking out is concerned. With that, buying on the dips continues to work, but a certain amount of patience will probably be needed to realize gains. Keep in mind that the pair is highly sensitive to risk appetite so that could come into play as well, as the Japanese yen is considered to be a “safety currency.”