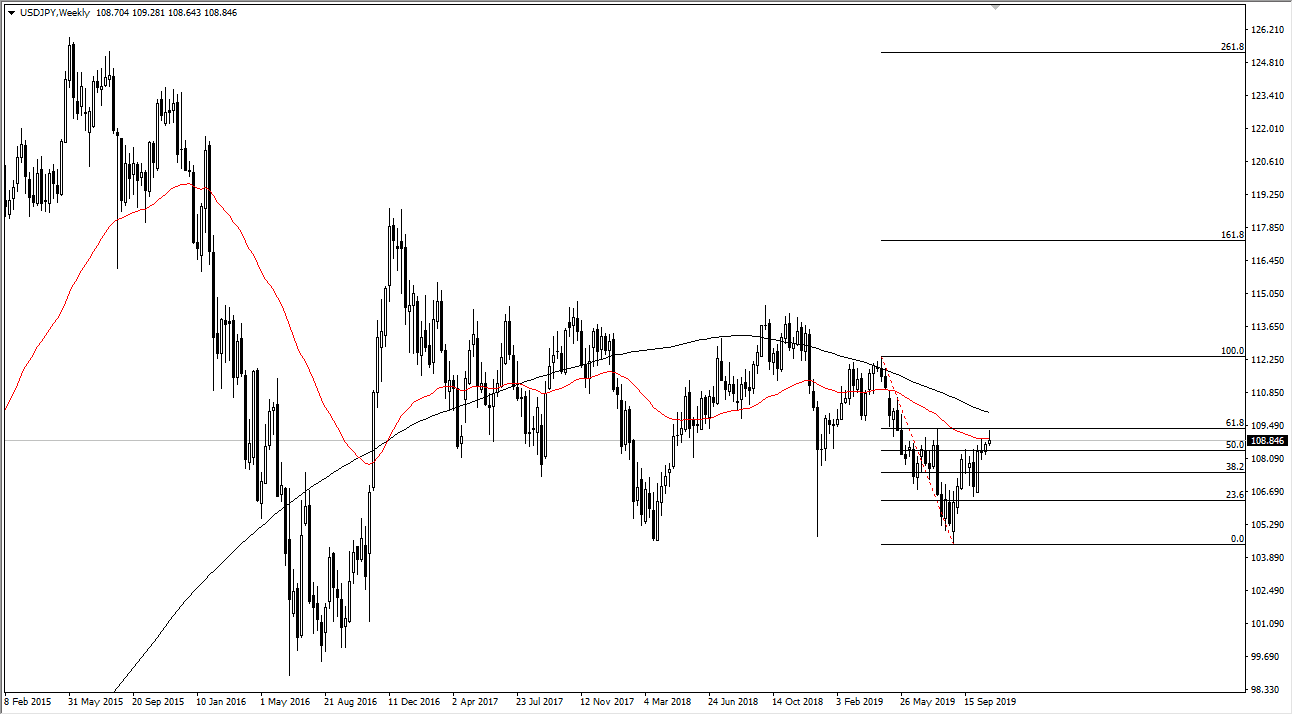

The US dollar has rallied during the month of October against the Japanese yen but started to stall once we got closer to the 61.8% Fibonacci retracement level at the ¥109.50 level. At this point, the market looks as if it could rollover a bit from here, and this pair will continue to move based upon risk appetite as the Japanese yen is considered to be a “safety currency.” At this point, the market is likely to rollover due to the fact that we have seen so much in the way of exhaustion, and it should also be pointed out that the 50 week EMA is slicing right through the tail candle that I’m looking at.

However, the jobs number could throw things around. If the market gets a weekly close above the ¥110 level, then it more than likely will send this pair looking towards the ¥112.50 level which is the 100% Fibonacci retracement level. With this, it would be a very bullish side and could send the market towards the 100% Fibonacci retracement level based upon the fact that more risk would be taken. The S&P 500 has broken to a fresh, new high, and that could send this market higher. However, if the market was to rollover from here it could show trouble in paradise as it were, sending risk assets lower. If we break down from here, it’s likely that the market could go down to the ¥107 level where we have seen a significant bounce.

The trade war headlines will of course continue to cause issues, so if things turn sour, the market will probably rollover. This is diverging just a bit from the close after the FOMC announcement though, as this is a very skittish candlestick while the S&P 500 has broken the fresh, new highs. This shows divergence, so one of these two markets will have to move in the opposite direction to make everything tidy up quite nicely. We have been in a downtrend for some time though, so keep in mind that a move lower could be rather rapid. The one thing that I would expect for the USD/JPY pair is to see a lot of volatility over the next several weeks, and therefore keeping a small position size might be the best way to trade this market. With that, keep in mind that the guidelines of the 61.8% Fibonacci retracement level and the ¥108.50 level should be paid close attention to.