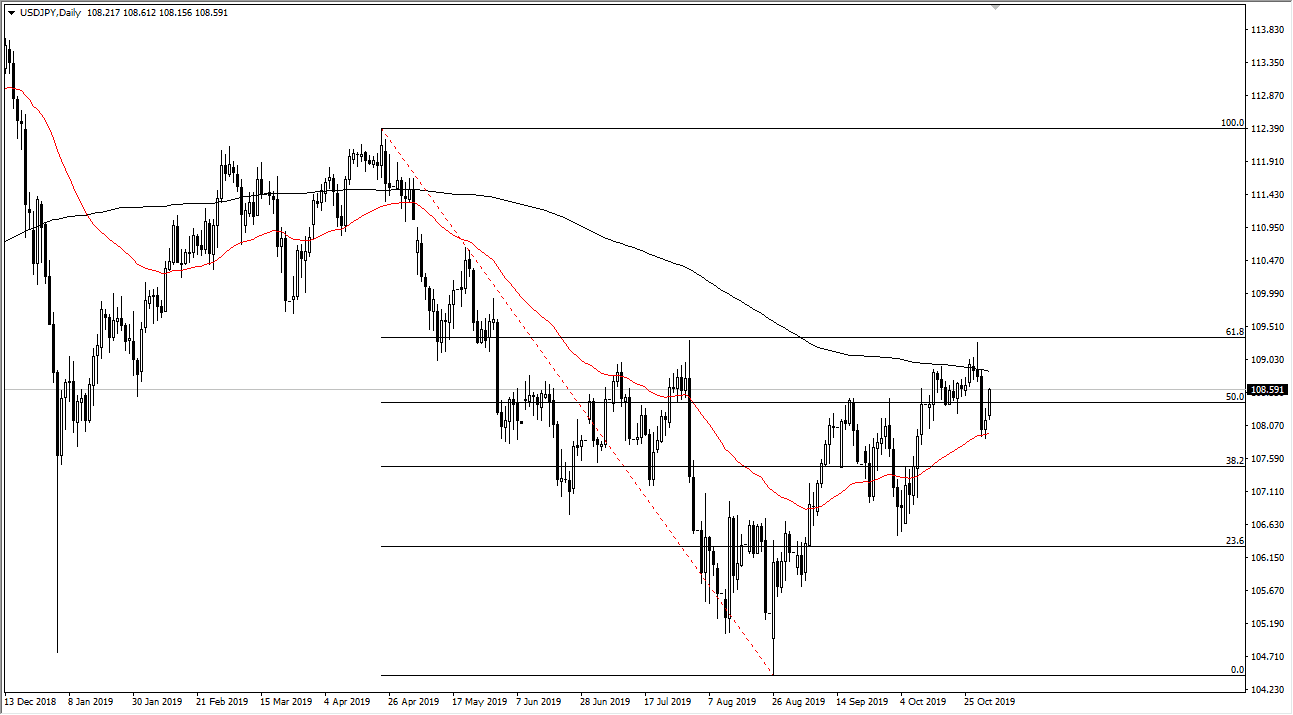

The US dollar has gapped higher to kick off the week, and then shot much higher. At this point, the market is likely to continue to reach towards the 200 day EMA, reaching towards the ¥109 level in the process. If we can break above the shooting star from last week, the market very likely reaches towards the 61.8% Fibonacci retracement level, and then by breaking that level, the market can continue to go much higher from here. If that happens, it’s very likely that the 100% Fibonacci retracement level will be tested at the ¥112 region.

Looking at the chart, it looks as if the 50 day EMA is starting to slope higher, perhaps getting ready to cross the 200 day EMA. This is a signal for longer-term traders, something referred to as the “golden cross.” This has a lot of longer-term “buy-and-hold” traders jumping into the market so it should signal that the market is ready to go higher. When you look at the chart from a high level, you can also make an argument for something akin to an “inverse head and shoulders”, so it’s possible that could kick off more buying as well. Regardless, the lows continue to get higher, and that of course is a good sign.

All things being equal, you should keep in mind that this pair does tend to move right along with other risk appetite based market such as the S&P 500, so it makes quite a bit of sense that this market rallies. Ultimately, if it pulls back, I would anticipate quite a bit of support underneath at the 50 day EMA, and then again at the ¥107 level, so I would look for value at that point. Ultimately, this is a market that continues to show signs of strength again.

I think it will remain very difficult and choppy to say the least, and at this point you should probably keep your position size relatively small as longer-term traders seem to be building up a larger core position, and it’s probably only a matter of time before we really start to take out. Overall, I don’t have any interest in shorting this market for the time being, but if we were to break down below the most recent low close near the ¥106.50 level, then it could change everything in shoot this market much lower.