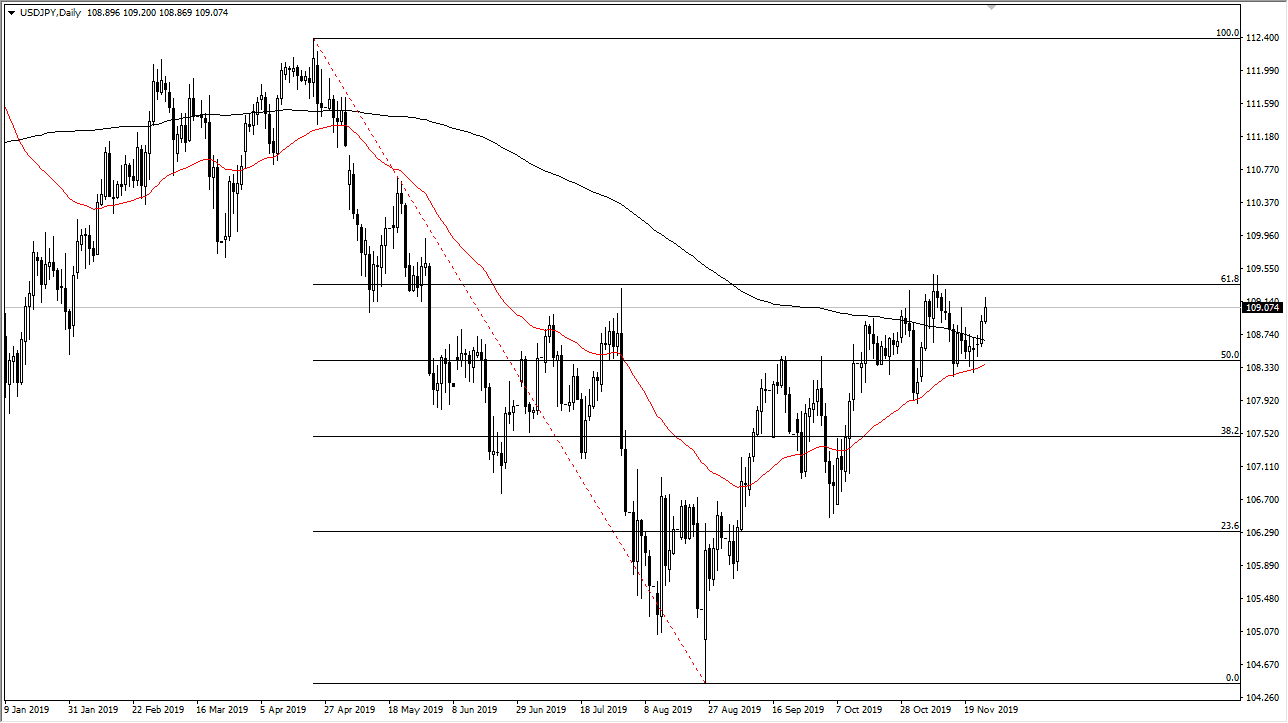

The US dollar rallied a bit during the trading session on Tuesday, reaching towards the crucial ¥109.50 level again before pulling back. At this point, the market will likely pull back given enough time, as there has been so much in the way of resistance in this general vicinity. If we were to break above the ¥110 level, then we will have cleared the 61.8% Fibonacci retracement level, and of course a large, round, psychologically significant figure. If we were to clear that level, then it’s very likely that the market goes towards the ¥111 level, and then possibly the ¥112.50 level which is the 100% Fibonacci retracement level.

All things being equal I think that the market will try to break out, but it needs some type of catalyst to finally make it happen. At this point, it’s probably going to have something to do with the US/China trade situation. If it gets better, then the market will reward the US dollar against the Japanese yen as it considered to be a major “safety currency.” At this point, the market should continue to find buyers underneath, especially closer to the 50 day EMA which is painted in red. It is getting closer to the 200 day EMA, and likely to break above it. That would be the “golden cross”, which is a longer-term “buy-and-hold” situation.

Looking at this chart, it’s not until we break down below the ¥107.50 level that I would be concerned. The question now is whether or not the couple of candlesticks that we have just formed when that being a “lower high” than the previous one or not. If it is, that could be the first signs of trouble. Ultimately, this is going to be a very difficult pair to trade simply because it is so heavily influenced by the US/China trade talks, which of course is complete nonsense at this point. The latest headline continues throw markets around, and it seems as if the politicians are going back and forth in order to goose the markets in whatever direction they want. With this being the case, headlines will continue to be a major driver, but it does look as if we are at least trying to build up the necessary pressure to make the breakout going forward. If we broke down, it’s probably going to end up being a negative sign of the US/China trade situation kicking the market lower.