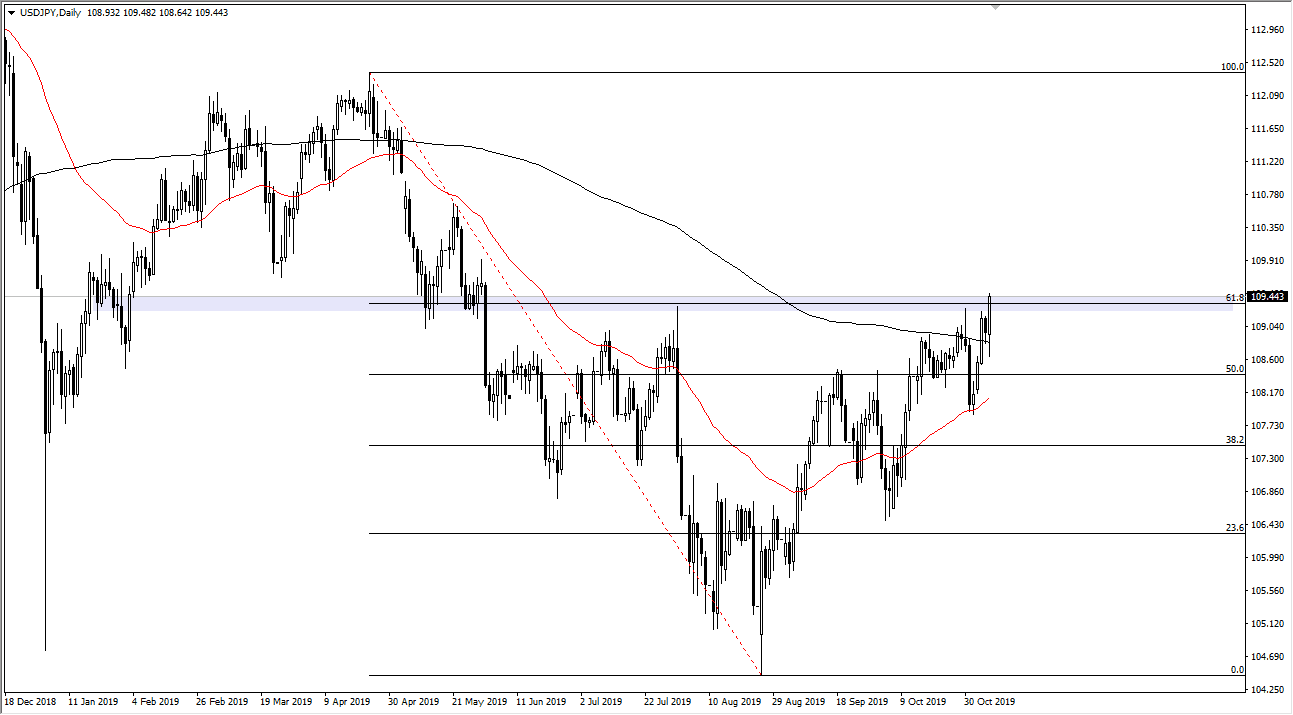

The US dollar initially fell during trading on Thursday but found a lot of buying underneath to push the market higher. By recovering the way, it did, we ended up proving the 200 day EMA to be crucial and supportive, but beyond that we have also tested the 61.8% Fibonacci retracement level. That essentially is the ¥109.50 handle, so breaking above there course will attract a lot of attention. This is the area that the market had broken down from previously, so if we were to wipe this area out and continue going higher, it would more than likely cause most Japanese yen related pairs to move away from the yen and into other riskier currencies.

Looking at this chart, it’s obvious that the 50 day EMA is starting to reach to higher levels, as it has offered support recently and it looks as if it could end up crossing the 200 day EMA which is what is known as a “golden cross”, which is a very bullish signal for longer-term traders. Looking at the candlestick for the trading session on Thursday, it’s obvious that we have seen a major turnaround, and after that move, it’s obvious that the market would continue to go higher. That being said, keep in mind that this is a market that is highly sensitive to risk appetite in general.

The momentum has certainly been to the upside for some time, so the fact that we managed to hang on to the market after the pullback suggests that we will see more of the same. Once we break out above this region, it’s likely that we will go looking towards the 100% Fibonacci retracement level above which is closer to the ¥112.50 level. Between here and there, there is also a gap that could be filled at the ¥111 level. I don’t have any interest in shorting this market, but I do recognize that if we were to break down below the ¥108 level, then it’s possible that we could roll over and kill that uptrend. It looks to be very unlikely right now and is a long as we continue to get good news out of the US/China situation that should continue to propel this market much higher as we start to risk more going forward. Pay attention to the headlines, they will drive where this market goes next.