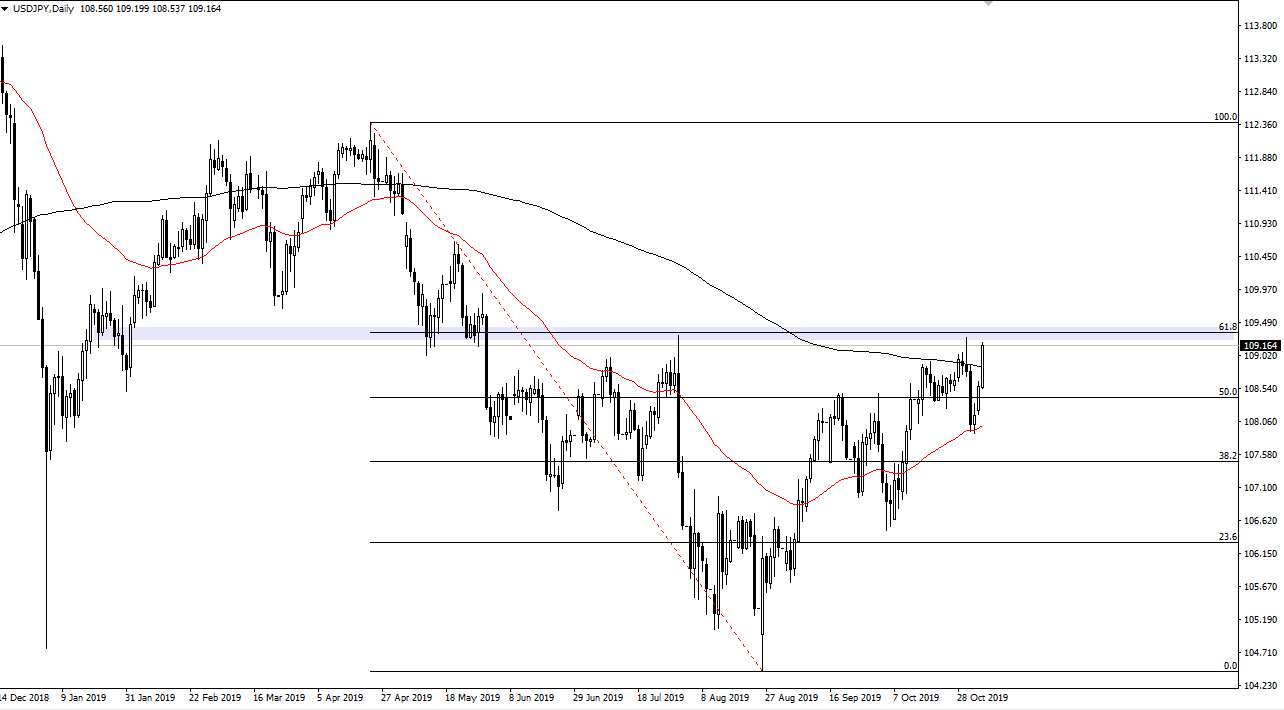

The US dollar has rallied significantly during the trading session on Tuesday as the ISM Nine Manufacturing PMI figures have come in much better than anticipated. Ultimately, the market looks as if it is ready to go higher, mainly based upon the US dollar find its strength everywhere due to the figures. This being the case, the market is likely to continue to try to take out the 61.8% Fibonacci retracement level just above, which is essentially the top of the shooting star from the session last week. A break above that level allows the market to go looking to higher levels, perhaps even the 100% Fibonacci retracement level which is closer to the ¥112 level.

One thing is for sure, the market is closing at the very top of the range and that is obviously a very bullish sign. Typically, that means there will be some type of continuation, but we could get a short-term pullback ¥108.50 level. The 50 day EMA is closer to the ¥108 level and turning higher. This should offer a bit of support, but the fact that we are closing so strongly during the trading session suggests that we may not even test that level.

Keep in mind that this pair is highly sensitive to the risk appetite around the world, and of course US dollar strength although the two don’t necessarily move at the same time. Ultimately, the market breaking above the ¥109.50 probably brings fresh money into this market, perhaps sending it much higher. It feels as if the market is trying to finally break out to the upside like a “Beachbody underwater”, meaning that once it breaks through, it should shoot straight up in the air.

Underneath, if we were to break below the 50 day EMA, the market is very likely to continue down towards the ¥107 level. All things being equal it looks as if the market is trying to break higher, and the 50 day EMA crossing the 200 day EMA which is known as the “golden cross” could be coming soon as well, as it is a very noteworthy indication I will be paying attention to it. That is a longer-term “buy-and-hold” signal, and therefore should bring in a lot of longer-term tactical traders. That’s a while away though, so we will have to wait to see whether or not it happens.