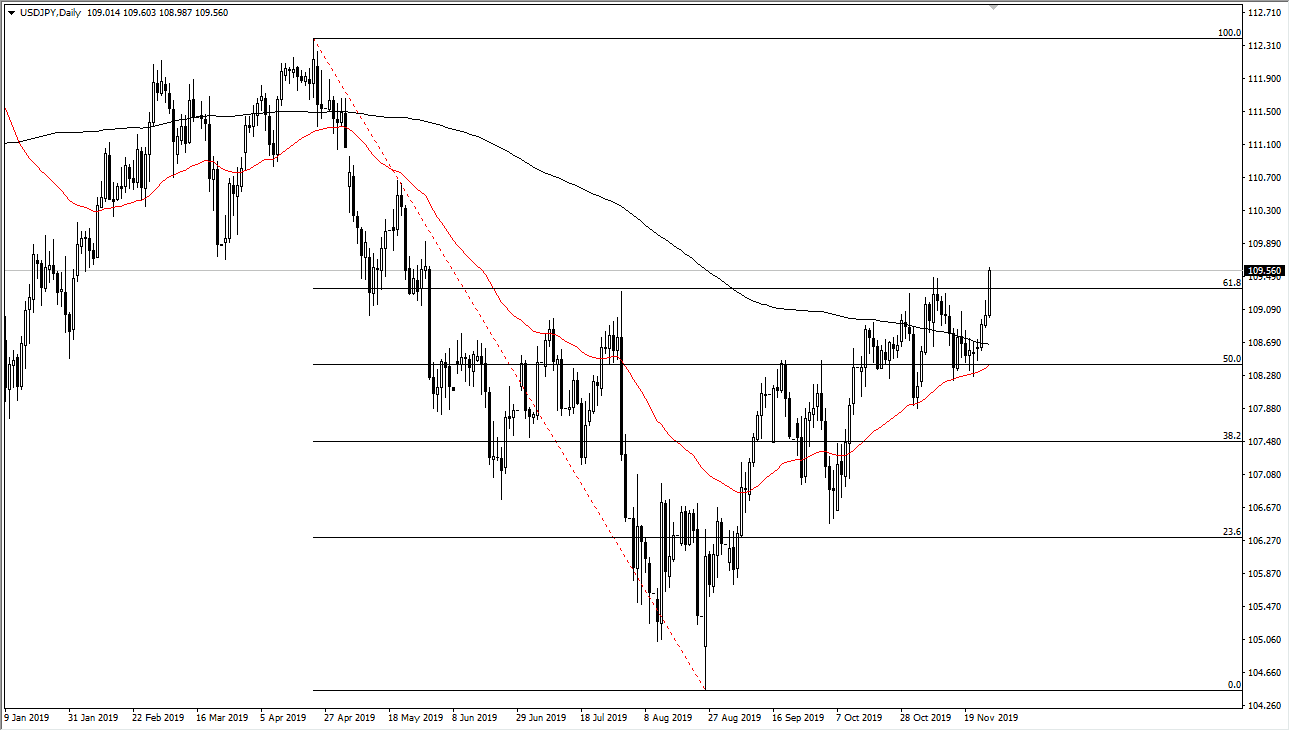

The US dollar has rallied significantly during the trading session on Wednesday, breaking to a fresh, new hunting, as we are looking to take off to the upside yet again. This is a market that has been trying as hard as they can to smash through the resistance, and it looks as if we are finally starting to do that.

Just above at the ¥110 level, that is the gateway to much higher pricing. At that point, it’s very likely that the market will go looking towards the ¥111 level, and then eventually the ¥112.50 level in the form of the 100% Fibonacci retracement level. This move is crucial, and the fact that it has happened suggests that we are going to continue to see more of a “risk on” type of move, which makes sense this time a year. I had been waiting for this breakout but quite frankly it took me a little bit by surprise because it looked earlier in the day as if we were going to pull back yet again to find the necessary momentum.

That being said, we have clearly found the necessary momentum, and although we have not cleared the ¥110 level this is a “shot across the bow” of the sellers and I think it’s only a matter of time before this does happen. As we start to head towards the “Santa Claus rally” on Wall Street, it makes quite a bit of sense that the USD/JPY pair will continue to rally as the Japanese yen loses its appeal. Remember, the Japanese yen is a safety currency, so of course it sells off when traders are willing to take quite a bit of risk. That being said, we get some type of ugly headline out there, this pair could turn right back around but it’s been very resilient for quite some time so it makes sense that we have seen this continued upward pressure, because every time it sells off the buyers eventually come back looking for value. The market is relentless in its drive higher, so every time the market participants think they are getting ready to sell the thing off, eventually we bounce hard. This is a sign that we will continue to reach to much higher levels and it’s only a matter of time before the dam breaks. I like buying dips at this point.