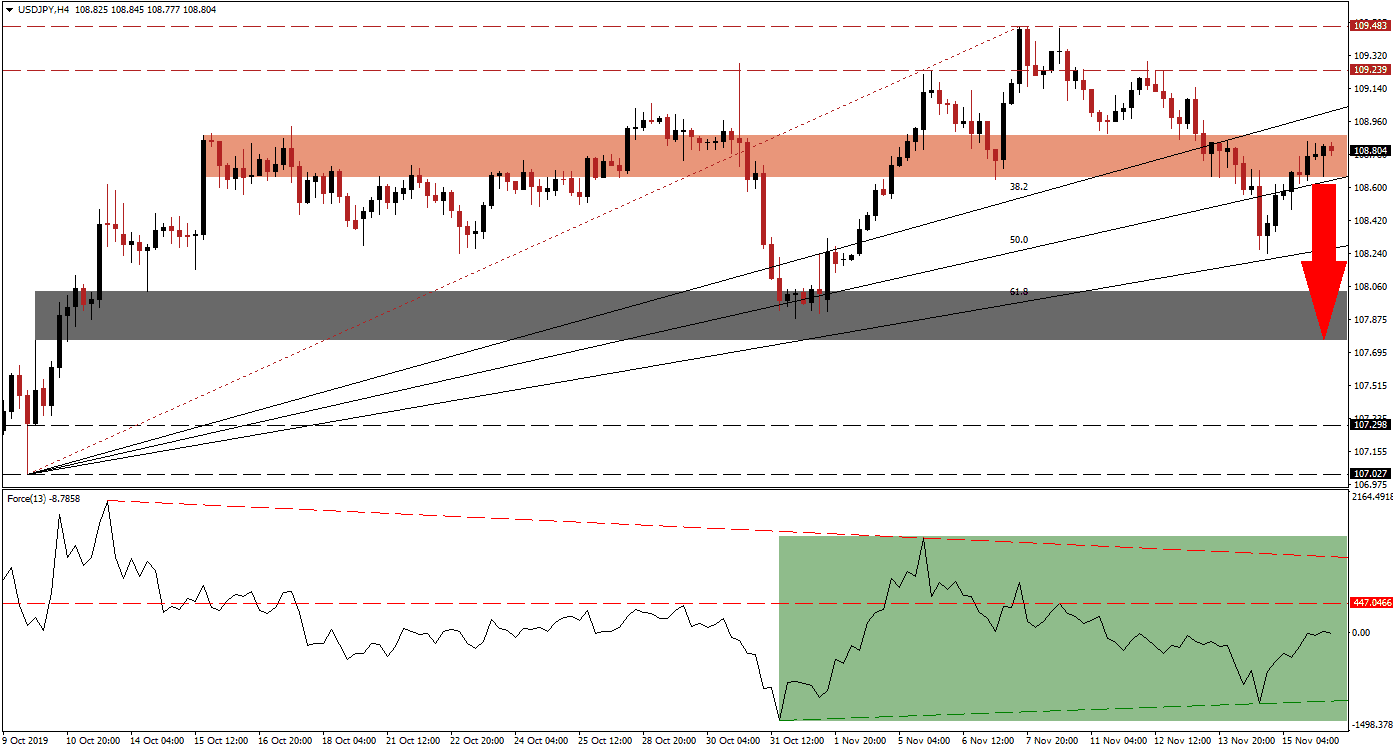

Despite numerous attempts by officials to show markets that the US and China are in the final process of finalizing their phase one trade truce, fundamental differences remain. Two key areas where both sides cannot find common ground are the removal of tariffs and agricultural purchases. For the time being, those issues are being ignored and a general risk-on mood prevails. The USD/JPY reversed the breakdown below its long-term resistance zone after reaching its ascending 61.8 Fibonacci Retracement Fan Support Level, and price action moved back into its short-term resistance zone.

The Force Index, a next-generation technical indicator, shows the loss in bullish momentum and reversed together with price action. The peak from where the reversal materialized marked a lower high as the USD/JPY recorded a higher high. Given a violent sell-off between both peaks, a negative divergence was invalidated. The Force Index pushed below its horizontal support level and turned it into resistance; this also placed it into negative territory and bears in charge of price action as marked by the green rectangle. You can learn more about the Force Index here.

Following the recovery off of the 61.8 Fibonacci Retracement Fan Support Level, this currency pair advanced into its short-term resistance zone located between 108.652 and 108.883 as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Support Level has reached the bottom range of this zone while the 38.2 Fibonacci Retracement Fan Resistance Level has already crossed above it. This is adding pressure on the USD/JPY to either breakout out and challenge its next long-term resistance zone or to breakdown into its next short-term support zone.

Given the fundamental disagreements between the US and China concerning their trade truce, the likelihood of a risk-off phase in financial markets remains dominant. This would favor the Japanese Yen which is considered a safe-haven asset. A breakdown in the USD/JPY is expected to take price action back down into its next short-term support zone which awaits between 107.761 and 108.031 as marked by the grey rectangle. A breakdown below this zone is possible, depending on the strength of bearish momentum. The next long-term support zone is located between 107.027 and 107.298. You can learn more about a breakdown here.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 108.800

⦁ Take Profit @ 107.800

⦁ Stop Loss @ 109.000

⦁ Downside Potential: 100 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 5.00

Should the Force Index advance and maintain a breakout above its horizontal resistance level, the USD/JPY may attempt a breakout. Upside potential is expected to be limited to its next log-term resistance zone located between 109.239 and 109.483; as long as the Force Index remains below its descending resistance level, the long-term bearish outlook remains in place for this currency pair. A move by price action into its long-term resistance zone should be considered a good short-selling opportunity.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 109.150

⦁ Take Profit @ 109.450

⦁ Stop Loss @ 109.000

⦁ Upside Potential: 30 pips

⦁ Downside Risk: 15 pips

⦁ Risk/Reward Ratio: 2.00