Investors' risk appetite weakened recently, supporting the USD/JPY drop to 108.23 support, but succeeded in closing the week around 108.80 resistance. Trump's remarks and recent Chinese demands weakened investor confidence in the completion of the first phase deal between the US and China. Some disappointing economic data contributed to the dollar's decline. White House economic adviser Larry Kudlow said recently that the agreement between the two largest economies "is approaching", the negotiators from both countries keep in touch every day. "It's not done yet but there has been very good progress and the talks have been very constructive," Kudlow said.

In the same context, US Commerce Secretary Wilbur Ross said the talks "depend on the final details" and the deal will be finalized "in any case."

Adding to the positive sentiment, China lifted a nearly five-year ban on US poultry imports in a goodwill gesture that could lead to annual shipments of more than $ 1 billion to China.

As for US economic news, a Federal Reserve report said that US industrial production fell more-than-expected in October, and the New York Fed report showed a slight slowdown in growth pace in regional industrial activity in November. The report said its general working conditions index fell to 2.9 in November from 4.0 in October. The Fed reported that industrial production fell -0.8% in October after falling -0.3% in September. Economists had expected output to fall by -0.4%, in line with the decline originally announced the previous month.

The Commerce Department reported that US retail sales rose 0.3% in October, following a 0.3% decline in September. Economists expected retail sales to rise 0.2%. Import prices in the US fell more-than-expected in October, according to a Labor Department report.

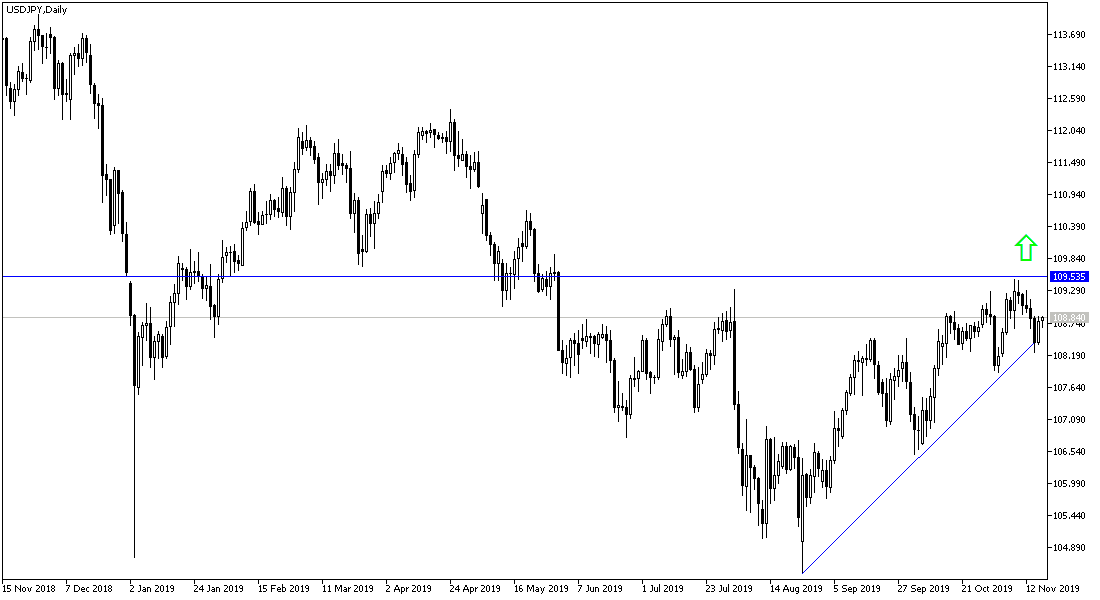

According to the technical analysis of the pair: In the short term, the price of USD/JPY is moving within a very volatile bullish channel, indicating a bullish bias according to market sentiment. The currency pair recently bounced off the 108.290 support trend line, but found strong resistance below 109.000. Therefore, bears will target short-term profits at around 108.641 or 108.481 or below at 108.290. On the other hand, bulls are hoping to continue the current uptrend towards 108.952 or 109.128 or higher at 109.276.

And in the long run, and based on the pair's performance on the daily chart, the pair continues to trade in a bullish channel after the recent bounce from 104.413 key support again on August 26th. The pair has retreated recently after approaching overbought RSI levels. Therefore, bears will target their long-term profits at 107.443, 106.379, 105.300 or below at 104.413. On the other hand, bulls are hoping to continue the rebound towards 109.395, 110.537, 111.113 or higher at 112.421.

Today's economic calendar has no significant data from either Japan or the US.