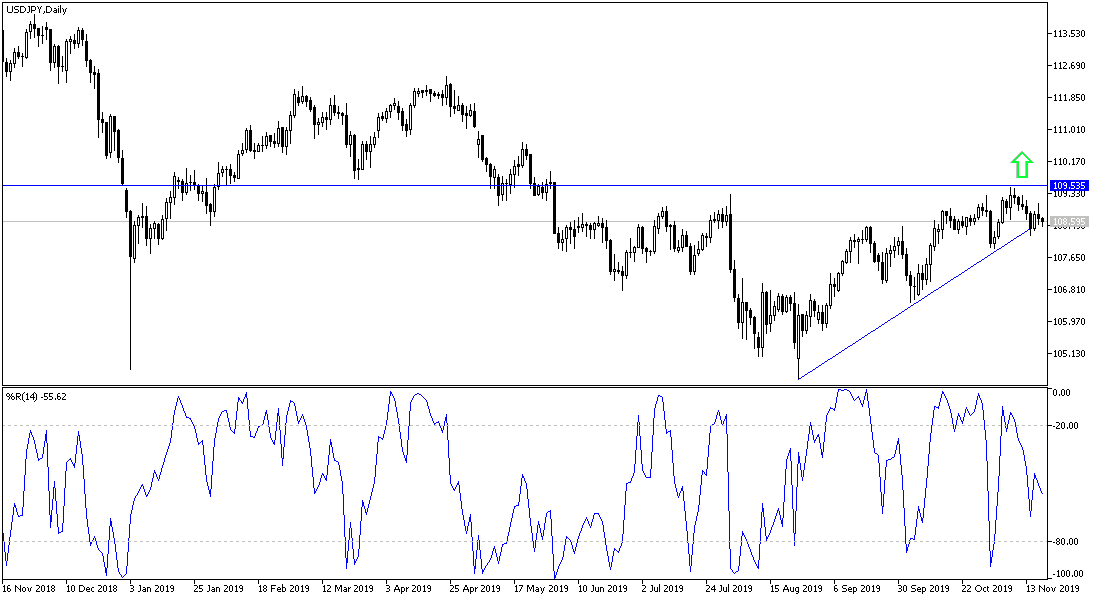

On the daily chart below, it seems clear that the USD/JPY is trying to avoid reaching the 108.00 support so as not to confirm the breach of the general bullish trend. During yesterday's session, it rose to 109.07 resistance, but returned to move down towards 108.60 support at the time of writing. Renewed concern over the future of the US-China trade agreement remains in favor of the Japanese yen as an ideal safe haven in times of uncertainty in financial markets. Yesterday, US President Donald Trump summoned Fed Chairman Jerome Powell to the White House to discuss the economy and interest rates - issues that Trump often attacked the Powell-led Fed for.

The US central bank remains confident in the economic performance of the United States and has stopped the rate cut until it monitors developments resulting from its three cuts throughout 2019. Most economists believe that Powell will continue to resist Trump's pressure. Some consider Jerome Powell politically more flexible than his predecessors, such as Ben Bernanke.

At the economic level. Following an unexpected announcement of improved confidence among US home builders the previous month, the National Association of Home Builders released a report showing that confidence fell slightly in November. The NAHB index fell to a reading of 70 in November after rising to 71 in October, the report said. Economists had expected the index to remain unchanged. The modest decline came after the housing market index rose for four consecutive months to its highest level since a similar reading in February 2018.

According to the technical analysis: The bearish momentum of USD/JPY will increase if it crosses the 108.00 support, and as a result, it may move towards stronger support levels near 107.75, 107.00 and 106.45 respectively, which may occur if pessimism persists for the future of a trade agreement for first phase between the two sides of the world trade war. On the upside, the 110.00 psychological resistance remains the key for the strength of this trend.

As for the economic calendar data today: There are no Japanese economic releases today and all focus will be on US data as the Commerce Department is scheduled to issue a detailed report on the residential construction in the country for the month of October. Housing starts are expected to jump to 1.320 million year-on-year in October after falling to 1.256 million in September. Economists expect building permits, an indicator of future housing demand, to fall to 1.385 million after falling to 1.387 million the previous month.