Undoubtedly, recent bearish correction attempts for USD/JPY have attracted the attention of traders interested in this pair. The pair fell to the 108.34 support before settling around 108.60 at the time of writing. Currency investors are wondering what levels are best for buying the pair. The best will be around the 108.00 support. According to the minutes of the latest meeting of the US central bank, the Fed stressed that its monetary policy is not on a predetermined path and could change if developments emerge that lead to a material reevaluation of economic outlook.

Referring to the assessment in the Bank's policy statement, monetary policy officials noted that information since the September meeting indicated that the labor market remained strong and that economic activity rose at a moderate rate. The minutes of the meeting also acknowledged that steady investment in exports and business remained weak, as weak global growth and developments in international trade continued to affect these sectors.

At this meeting, Fed members voted to cut US interest rates by 25 basis points. Officials who supported the rate cut saw it as consistent with helping offset the effects of aggregate demand on global growth and weak trade developments, insuring against downside risks from those factors, and bolstering the Fed's inflation target of around 2 percent.

Kansas City Fed President, Esther George and Boston Fed President, Eric Rosengren preferred to leave interest rates unchanged, suggesting that the economic outlook remains positive and they expect growth to continue even if interest rates are maintained from 1-3/4 Percent to 2 percent. The minutes showed that members agreed that the timing and magnitude of future interest rate adjustments would be based on assessments of realized and anticipated economic conditions.

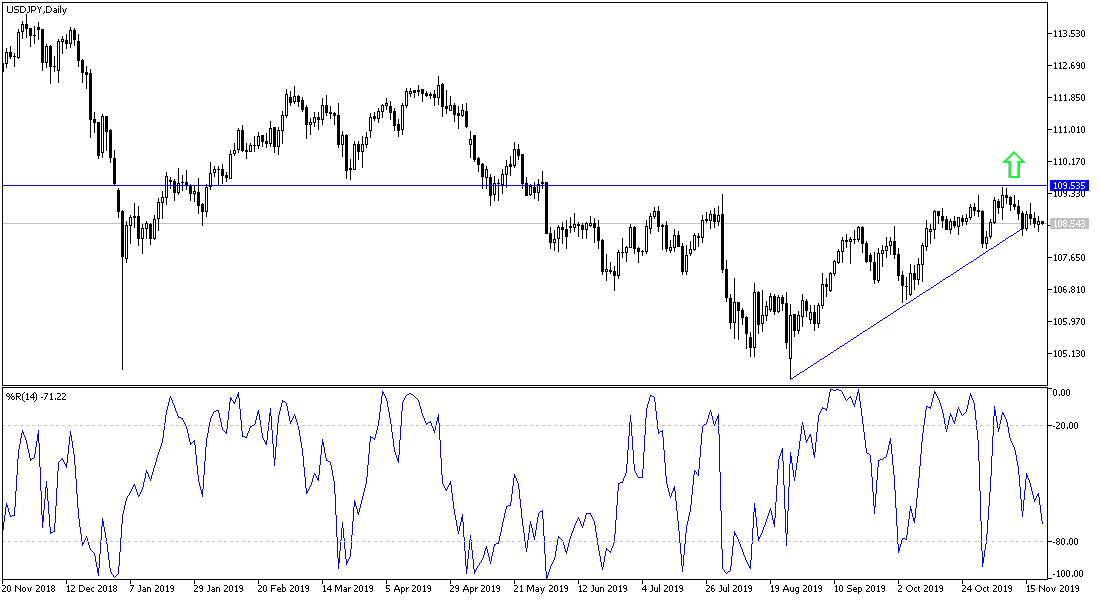

According to the technical analysis of the pair: Breaking the USD/JPY pair of the 108.00 support and moving below it will support breaking the uptrend of the pair as shown on the daily chart below and may push the pair to the strongest support levels, which are currently at 108.20, 107.65 and 106.90 respectively. On the upside, the bullish outlook will strengthen if the pair quickly returns to 110 psychological resistance. The development of the US-China trade agreement will be a powerful influence on the pair's direction.

As for the economic calendar data today: From Japan we will announce the activity of all industries. The US is to release the Philadelphia Industrial Index, jobless claims and existing home sales data.