The USD/JPY price did not celebrate its gains at the beginning of last week, which pushed it to the 109.28 resistance, its highest level in three months. It soon returned to a correction down to the 107.88 support at the end of the week's trading, supported by the Federal Reserve interest rates cut for the third time in 2019, in addition to the mixed results of the US Department of Labor report, which showed a higher-than-expected rise in US non-farm payrolls, high unemployment rate in the country and increase in average hourly wages. The pair closed the week around 108.16. We may see a relatively quiet week for major US economic releases, but renewed global trade and geopolitical tensions must be monitored as they will naturally benefit the Japanese yen.

Non-farm payrolls in the United States exceeded expectations by 89,000, with a reading of 128,000 for October, down from 180,000 in the previous month. The unemployment rate and average hourly wage growth for October (yearly) were in line with expectations of 3.6% from 3.5% in September and 3.0%. The revised rate was upward by 3.0% over the previous month, and the labor force participation rate of 63.3% was slightly higher than the expected rate of 63.2%, but the average hourly wage change increased by 0.2% and was expected to 0.3% and the change was 0.0% the previous month.

On the other hand, Japan's CPI in October beat expectations by 0.7% (YoY) against 0.5%. Prior to that, the Tokyo CPI for the same month also came in below expectations after 0.4% vs. 0.5% (YoY).

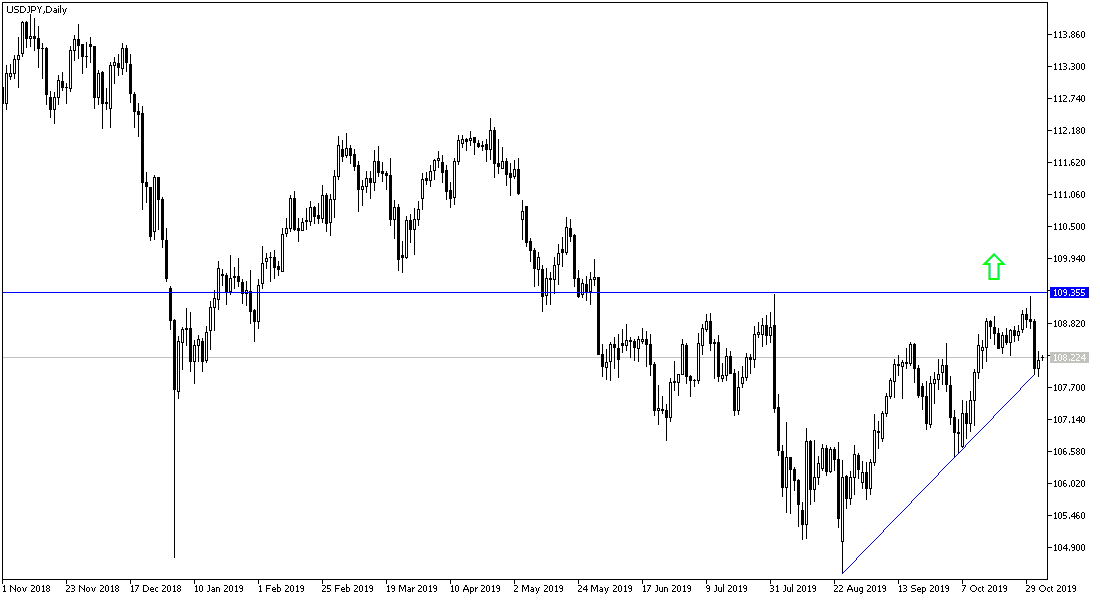

According to the technical analysis of the pair: On the daily chart, it appears that the price of the USD/JPY is still trading under intense upward pressure. The pair made a bullish reversal at the beginning of August and has continued to trade within a sharp bullish channel ever since. Based on Fibonacci retracements from the April and July declines, bulls will target long-term profits at around 108.428 (61.80% Fib) or higher at 110.537 (76.60% Fib). On the other hand, bears will have multiple profit opportunities below at 106.369 support (38.20% Fib) or below at 105.499 support.

As for the economic calendar data today: There is a holiday in Japan. From the USA, we have factory orders data.