Investors returned to safe havens as the future of the upcoming US-China trade deal became increasingly uncertain, which was a good reason for the USD/JPY to fall to the 108.35 support in the morning trades ahead of the release of the US Federal Reserve’s last meeting minutes. Jerome Powell just broke market expectations, as per his testimony to the US Congress last week and his remarks after a meeting with U.S. President Trump, the bank will be in a wait-and-see position after the bank's three rate cuts in 2019. Powell ignored Trump's continuing criticism for a deeper US rate cut as he sees the US economic performance remains strong.

Adding to investor appetite for the Japanese yen as a sanctuary was the political crisis in Hong Kong, which is still severe. The confrontation continues and the situation is still ominous. At the same time, the escalation of violence and unrest cannot continue. The United States supported the call for an independent inquiry into the unrest and expressed concern about the use of unnecessary force, although it is largely silent about violence in other countries facing social unrest such as Bolivia. The US Senate is seeking to impose new export controls to ensure a ban on goods that could be used by Hong Kong or China to clamp down.

In contrast, Bank of Japan Governor Kuroda also stressed the possibility of lowering interest rates if necessary, and stressed the importance of fiscal policy in moving the economy forward. He expressed his worries about weak exports and a sales tax hike. The world's third-largest economy faces deflation risks and the Bank of Japan has to be on high alert. Meanwhile, Japan's House of Representatives approved a trade agreement with the United States. The Supreme Council is expected to approve the deal by December 9 when the current session ends.

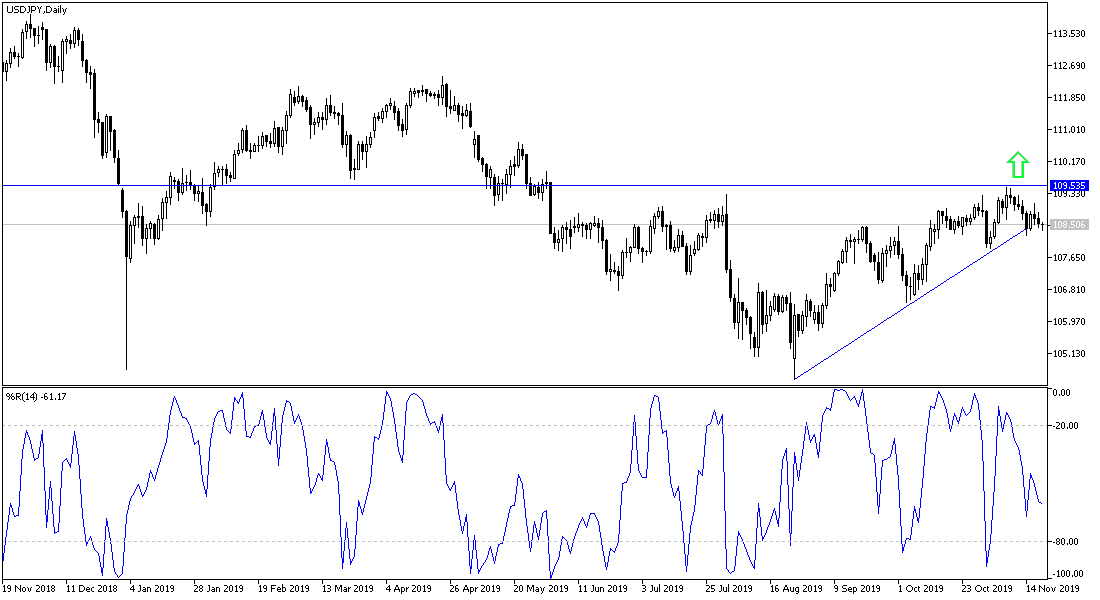

According to the technical analysis of the pair: USD/JPY approaching near the 108.00 support and breaching it will confirm the break of the uptrend as shown on the daily chart below. Currently the closest support levels are 108.25, 107.70 and 106.90 respectively. I still prefer to buy the pair from every bearish level. The bullish trend will not strengthen, as we expected before and we confirm now, without the pair moving towards 110.00 psychological resistance. The first phase trade deal between the United States and China will have a strong reaction to the pair's performance in the coming days.

As for the economic calendar data today: From Japan, the trade balance will be announced. From the US, crude oil inventories and the contents of the minutes of the last Fed meeting.